In the ever-evolving landscape of small business operations, finding the right virtual terminal can be a game-changer. As we venture into the year 2023, the options are more abundant than ever before. From sleek designs to advanced features, these virtual terminals provide the necessary tools for small businesses to streamline their payment processes. In this article, we will explore the seven best virtual terminals available in 2023, helping you find the perfect fit for your business needs. So, let’s dive into the world of virtual terminals and discover how they can revolutionize your small business operations.

1. Square Virtual Terminal

Square Virtual Terminal is a popular option for small businesses looking for an easy and reliable way to process payments. It comes with a range of features that make it a versatile and convenient choice.

Features

Square Virtual Terminal allows you to accept payments in-person or remotely through the browser-based interface. This means that you can accept payments from anywhere as long as you have an internet connection. It also supports various payment methods, including credit cards, debit cards, and mobile wallets.

The platform also offers features like customizable receipts, inventory management, and sales reporting. This can help you streamline your business operations and keep track of your sales and inventory in one place. Additionally, it provides tools for managing refunds and issuing partial or full refunds when necessary.

Pricing

Square Virtual Terminal offers transparent and straightforward pricing. There are no monthly fees or long-term contracts. Instead, you pay a processing fee for each transaction. The processing fees vary depending on the type of transaction, such as in-person or remote payments.

Pros

- Easy to use and set up, with a user-friendly interface

- Versatile payment options for both in-person and remote transactions

- Customizable receipts and inventory management features

- Transparent pricing with no monthly fees

Cons

- Availability of certain features may vary depending on your location

- Higher processing fees for certain types of transactions compared to other virtual terminals

2. PayPal Virtual Terminal

PayPal Virtual Terminal is another popular choice for small businesses. It offers a range of features that make it a convenient and reliable option for processing payments.

Features

PayPal Virtual Terminal allows you to accept payments through a virtual terminal or the PayPal Here mobile app. This gives you the flexibility to process payments whether you’re at your desk or on the go. It supports various payment methods, including credit cards, debit cards, and PayPal.

The platform also provides features like customizable receipts, invoicing, and sales reporting. This can help you streamline your business operations and keep track of your transactions. Additionally, it offers tools for managing refunds and issuing partial or full refunds as needed.

Pricing

PayPal Virtual Terminal offers a simple pricing structure. There are no monthly fees or setup fees. Instead, you pay a processing fee for each transaction. The processing fees vary depending on the type of transaction and your sales volume.

Pros

- Flexible payment options through virtual terminal or mobile app

- Supports various payment methods, including credit cards, debit cards, and PayPal

- Customizable receipts, invoicing, and sales reporting features

- No monthly fees or setup fees

Cons

- Some users may find the interface and navigation a bit complex compared to other virtual terminals

- Processing fees can be higher for certain types of transactions, especially for international payments

3. Stripe Terminal

Stripe Terminal is a comprehensive virtual terminal solution that caters to small businesses seeking a robust payment processing option.

Features

Stripe Terminal enables businesses to accept payments through a physical credit card reader, a mobile app, or an online interface. This flexibility allows you to choose the option that best suits your specific business needs. It supports major credit and debit cards, as well as digital wallets like Apple Pay and Google Pay.

The platform also offers features like inventory management, customer creation, and real-time analytics. These tools can help you streamline your operations, build a customer database, and gain valuable insights into your sales and performance.

Pricing

Stripe Terminal offers transparent pricing with no setup fees or monthly charges. Instead, you pay a processing fee for each transaction. The processing fees vary depending on the type of transaction and your sales volume.

Pros

- Wide range of payment acceptance options, including physical card readers, mobile app, and online interface

- supports major credit and debit cards, as well as digital wallets

- Advanced features like inventory management, customer creation, and real-time analytics

- Transparent pricing with no setup fees or monthly charges

Cons

- Some users may find the initial setup and integration process complex

- Certain advanced features may require technical knowledge or coding experience

4. Shopify POS

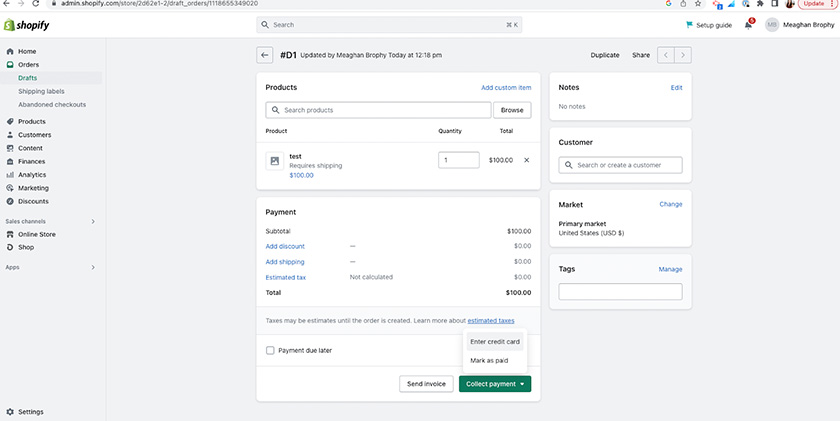

Shopify POS is a popular virtual terminal solution for small businesses that are already using the Shopify e-commerce platform.

Features

Shopify POS allows you to accept payments in-person, whether you have a physical store or selling at events or pop-up shops. It supports various payment methods, including credit cards, debit cards, and mobile wallets. The platform also offers features like inventory management, customer profiles, and sales analytics.

Additionally, Shopify POS seamlessly integrates with other Shopify tools and services, such as online store management and order fulfillment. This provides you with a comprehensive solution for managing your business operations.

Pricing

Shopify POS offers flexible pricing plans to accommodate businesses of different sizes and needs. The pricing includes the virtual terminal functionality as well as other Shopify features like online store management and order fulfillment. The pricing plans vary depending on the features and services you require.

Pros

- Seamless integration with other Shopify tools and services

- In-person payment acceptance with support for various payment methods

- Inventory management, customer profiles, and sales analytics features

- Flexible pricing plans to accommodate businesses of different sizes and needs

Cons

- Users who are not already using Shopify may find the learning curve steep

- Additional fees may apply for certain features or services, depending on your pricing plan

5. Authorize.Net

Authorize.Net is a widely recognized virtual terminal solution that offers secure and reliable payment processing for small businesses.

Features

Authorize.Net enables businesses to accept payments from various sources, including credit cards, debit cards, and electronic checks. It supports recurring payments, allowing you to set up automatic billing for subscription-based services. The platform also provides features like fraud prevention, address verification, and customizable receipts.

Additionally, Authorize.Net offers integration with popular e-commerce platforms and shopping carts, making it easier to manage your online store and streamline your payment processing.

Pricing

Authorize.Net offers multiple pricing options to suit different business needs. The pricing includes a monthly gateway fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Secure and reliable payment processing with multiple payment acceptance options

- Support for recurring payments and automated billing

- Fraud prevention and address verification features

- Integration with popular e-commerce platforms and shopping carts

Cons

- Monthly gateway fee and per-transaction fee may be higher compared to other virtual terminals

- Some users may find the setup and configuration process complex

6. Payline Virtual Terminal

Payline Virtual Terminal is a robust payment processing solution that caters to small businesses seeking a comprehensive virtual terminal experience.

Features

Payline Virtual Terminal offers businesses the ability to accept payments from various sources, including credit cards, debit cards, and mobile wallets. It supports in-person and remote payment options, providing flexibility for businesses of different types. The platform also provides features like inventory management, customer databases, and customizable reporting.

Payline Virtual Terminal also provides robust security measures, including PCI compliance and encryption, to protect your customers’ sensitive payment information.

Pricing

Payline Virtual Terminal offers flexible pricing plans based on your business needs. The pricing includes a monthly fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Multiple payment acceptance options for in-person and remote transactions

- Inventory management, customer databases, and customizable reporting features

- Robust security measures to protect sensitive payment information

- Flexible pricing plans based on business needs

Cons

- Monthly fee and per-transaction fee may be higher compared to other virtual terminals

- Some users may find the interface and navigation less intuitive than other options

7. Wix Virtual Terminal

Wix Virtual Terminal is an easy-to-use and affordable payment processing solution designed for small businesses using the Wix website builder.

Features

Wix Virtual Terminal allows businesses to accept payments through a virtual terminal or a mobile app. It supports various payment methods, including credit cards, debit cards, and mobile wallets. The platform also provides features like sales reporting, customer management, and customizable receipts.

Additionally, Wix Virtual Terminal integrates seamlessly with your Wix website, allowing you to manage your online store and payment processing in one place.

Pricing

Wix Virtual Terminal offers transparent and affordable pricing plans. The pricing includes a monthly fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Easy-to-use interface and seamless integration with Wix website builder

- Support for various payment methods, including credit cards, debit cards, and mobile wallets

- Sales reporting, customer management, and customizable receipts features

- Transparent and affordable pricing plans

Cons

- Advanced features and customization options may be limited compared to other virtual terminals

- Some users may find the customer support options less extensive than other options

8. Fiserv Virtual Terminal

Fiserv Virtual Terminal is a comprehensive payment processing solution that combines flexibility and reliability for small businesses.

Features

Fiserv Virtual Terminal allows businesses to accept payments from various sources, including credit cards, debit cards, and mobile wallets. It supports in-person, phone, and online payment options, providing flexibility for businesses of different types. The platform also provides features like inventory management, detailed reporting, and customer database management.

Fiserv Virtual Terminal integrates with other Fiserv solutions, such as ecommerce capabilities and fraud prevention tools, allowing you to streamline your business operations.

Pricing

Fiserv Virtual Terminal offers customized pricing plans based on your business needs. The pricing includes a monthly fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Multiple payment acceptance options for in-person, phone, and online transactions

- Inventory management, detailed reporting, and customer database management features

- Integration with other Fiserv solutions for streamlined operations

- Customized pricing plans based on business needs

Cons

- Monthly fee and per-transaction fee may be higher compared to other virtual terminals

- Some users may find the setup and integration process more complex compared to other options

9. QuickBooks Virtual Terminal

QuickBooks Virtual Terminal is a convenient payment processing solution designed for small businesses using QuickBooks accounting software.

Features

QuickBooks Virtual Terminal allows businesses to accept payments through a virtual terminal or the QuickBooks mobile app. It supports various payment methods, including credit cards, debit cards, and mobile wallets. The platform also provides features like invoicing, sales tracking, and customizable reporting.

Additionally, QuickBooks Virtual Terminal integrates seamlessly with your QuickBooks accounting software, allowing you to manage your payments and financials in one place.

Pricing

QuickBooks Virtual Terminal offers transparent pricing with no setup fees or cancellation fees. The pricing includes a monthly fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Seamless integration with QuickBooks accounting software

- Support for various payment methods, including credit cards, debit cards, and mobile wallets

- Invoicing, sales tracking, and customizable reporting features

- Transparent pricing with no setup fees or cancellation fees

Cons

- Monthly fee and per-transaction fee may be higher compared to other virtual terminals

- Some users may find the interface and navigation less intuitive than other options

10. PayJunction

PayJunction is a reliable and environmentally friendly virtual terminal solution that prioritizes security and convenience for small businesses.

Features

PayJunction enables businesses to accept payments from various sources, including credit cards, debit cards, and electronic checks. It supports in-person, phone, and online payment options, providing flexibility for businesses of different types. The platform also provides features like inventory management, detailed reporting, and customer database management.

PayJunction also stands out for its commitment to environmental sustainability by reducing the need for paper receipts and promoting digital transactions.

Pricing

PayJunction offers customized pricing plans based on your business needs. The pricing includes a monthly fee, a per-transaction fee, and other optional add-on services. The fees vary depending on your sales volume and the specific features you require.

Pros

- Multiple payment acceptance options for in-person, phone, and online transactions

- Inventory management, detailed reporting, and customer database management features

- Commitment to environmental sustainability with reduced need for paper receipts

- Customized pricing plans based on business needs

Cons

- Monthly fee and per-transaction fee may be higher compared to other virtual terminals

- Some users may find the setup and configuration process complex

Leave a Reply