Are you looking for a way to take your business to the next level? Look no further! In this article, we will explore the ultimate guide to scaling your business with recurring billing. With the help of recurring billing, you can streamline your revenue stream and generate consistent income month after month. Whether you’re a small startup or an established business, our guide will provide you with essential tips and insights to successfully implement recurring billing into your business model. Get ready to unlock the potential for exponential growth and financial stability for your business!

1. Understanding recurring billing

1.1 What is recurring billing?

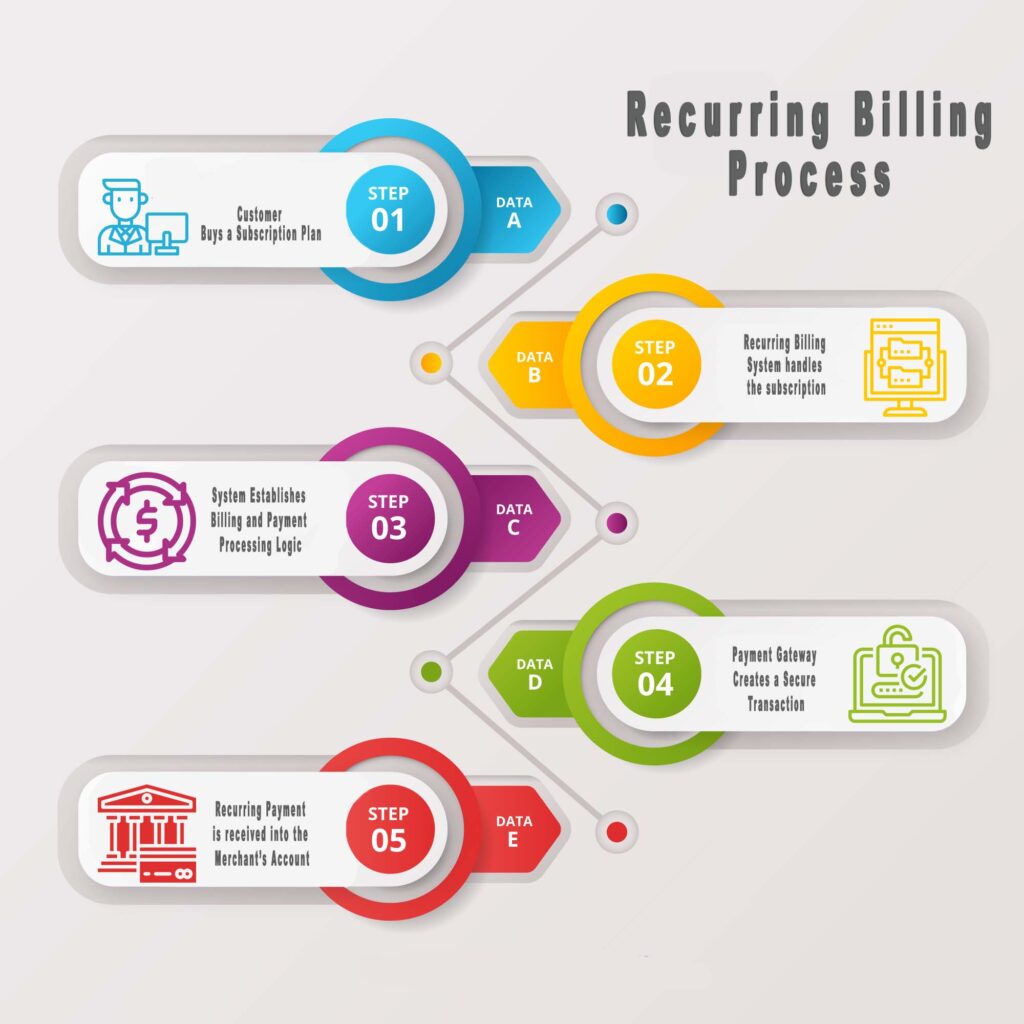

Recurring billing, also known as subscription billing or automatic billing, is a payment model that allows businesses to regularly charge their customers for products or services on a recurring basis. Instead of relying on one-time transactions, recurring billing enables businesses to establish long-term relationships with their customers by automating the payment process.

1.2 Benefits of recurring billing

Recurring billing offers numerous benefits to both businesses and customers. By offering a convenient and hassle-free payment option, businesses can improve cash flow, increase customer loyalty, and create a predictable revenue stream. Customers, on the other hand, can enjoy the ease of recurring payments without the need for manual intervention, ensuring a seamless and convenient experience.

1.3 Types of recurring billing models

There are several types of recurring billing models that businesses can choose from, depending on their specific needs and industry. The most common models include:

- Fixed recurring billing: This model charges customers a fixed amount on a regular interval, such as monthly or annually. It is commonly used for subscription-based services.

- Metered recurring billing: In this model, the cost of the product or service is determined by its usage or consumption. Utility companies often utilize this model, charging customers based on their usage of electricity or water.

- Tiered recurring billing: This model offers different tiers or plans with varying levels of features or benefits, allowing customers to choose the plan that best suits their needs. It is often used by software-as-a-service (SaaS) companies.

2. Setting up a recurring billing system

2.1 Choosing the right payment processor

One of the crucial steps in setting up a recurring billing system is selecting the right payment processor. It’s important to choose a processor that offers robust recurring payment capabilities, secure data storage, and reliable customer support. Additionally, consider factors such as transaction fees, integration options with your existing systems, and compatibility with popular payment methods.

2.2 Integrating recurring billing into your website

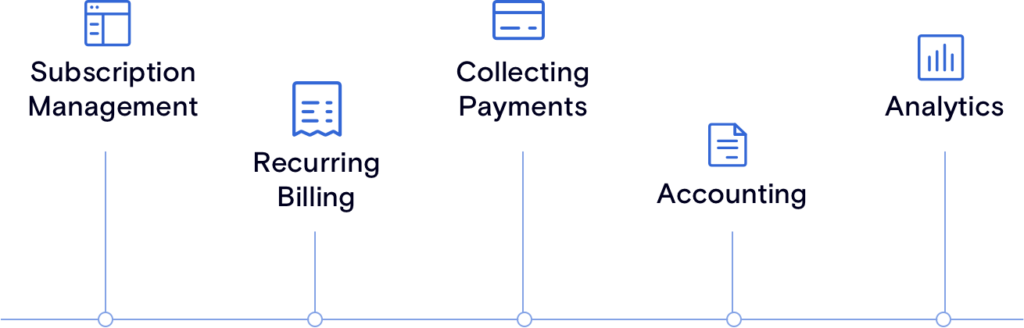

To seamlessly integrate recurring billing into your website, you’ll need to work with your payment processor and web developer. The integration process involves adding a subscription management portal, payment forms, and automated billing workflows to your site. This ensures that customers can easily subscribe to your services, update their payment details, and manage their subscriptions.

2.3 Ensuring security and customer data protection

When implementing a recurring billing system, prioritizing security and customer data protection is essential. Ensure that your payment processor is PCI DSS compliant and follows industry best practices for securing customer information. Implement measures such as encryption, secure tokenization, and fraud detection systems to safeguard sensitive data and mitigate the risk of payment fraud.

2.4 Defining billing cycles and payment terms

To establish a successful recurring billing system, it’s crucial to define clear billing cycles and payment terms. Determine the frequency at which customers will be charged, such as monthly, quarterly, or annually. Additionally, establish policies regarding payment due dates, grace periods, and late fees. Clearly communicate these terms to customers to avoid misunderstandings or disputes down the line.

3. Maximizing customer acquisition and retention

3.1 Offering flexible subscription plans

To attract a broader customer base and cater to different needs, consider offering flexible subscription plans. This can include options for different pricing tiers, billing frequencies, or package combinations. By providing choices and customization, you can accommodate a wide range of customers and increase the likelihood of acquiring and retaining them.

3.2 Providing value-added services

To enhance your offering and increase customer satisfaction, consider providing value-added services alongside your core product or service. These can include exclusive access to premium content, priority support, or additional features. By offering these extras, you can differentiate yourself from competitors and provide further incentives for customers to stay subscribed.

3.3 Seamless onboarding experience

The onboarding experience plays a significant role in retaining customers. Ensure that the signup process is straightforward, intuitive, and user-friendly. Provide clear instructions, minimize the number of steps required, and offer assistance when needed. A seamless onboarding experience can contribute to a positive first impression and increase the chances of customer retention in the long run.

3.4 Customer support and communication

Maintaining open lines of communication with your customers is crucial for building strong relationships and addressing any concerns or issues promptly. Provide multiple channels for customer support, such as email, chat, or phone, and ensure that your team responds in a timely manner. Regularly engage with your customers through newsletters, updates, or personalized offers to foster a sense of connection and loyalty.

4. Optimizing pricing and revenue

4.1 Pricing strategies for recurring billing

Effective pricing strategies can greatly impact your recurring revenue. Consider various approaches such as flat-rate pricing, volume-based pricing, or usage-based pricing, depending on your business model and industry. Test different pricing models and gather feedback from customers to determine the optimal pricing strategy that maximizes revenue while providing value to customers.

4.2 Implementing tiered pricing

Tiered pricing offers customers different levels of your product or service at varying price points. This allows customers to choose the option that aligns best with their needs, increasing the likelihood of conversion and customer satisfaction. Carefully design your tiered pricing structure to appeal to a broad range of customers, ensuring that each tier offers compelling features and benefits.

4.3 Upselling and cross-selling opportunities

Take advantage of upselling and cross-selling opportunities to increase your average revenue per customer. Offer upgrades or additional features to existing customers, encouraging them to invest more in your product or service. Additionally, identify complementary products or services that you can cross-sell to your customer base, expanding your revenue streams and maximizing customer lifetime value.

4.4 Monitoring and adjusting pricing

Regularly monitor and analyze your pricing performance to identify areas for improvement. Use analytics tools to track key metrics such as churn rate, customer acquisition cost, and customer lifetime value. Consider conducting pricing experiments or surveys to gather feedback from customers and adjust your pricing strategies accordingly. Continuously optimizing your pricing can help you stay competitive and maximize your revenue potential.

5. Managing customer churn

5.1 Identifying factors causing churn

Customer churn, or the rate at which customers cancel their subscriptions, can significantly impact your recurring revenue. It’s crucial to identify the factors that lead to churn and address them proactively. Monitor customer behavior, gather feedback, and analyze patterns to determine common reasons for churn, such as poor product fit, lack of perceived value, or customer service issues.

5.2 Implementing customer retention strategies

Once you’ve identified the factors causing churn, develop targeted customer retention strategies. This can include personalized offers or discounts, proactive customer outreach, or feature enhancements based on customer feedback. By demonstrating value and addressing customer concerns, you can increase satisfaction and reduce churn over time.

5.3 Analyzing customer feedback and satisfaction

Regularly collect and analyze customer feedback to gain insights into their satisfaction levels and identify areas for improvement. This can be done through surveys, feedback forms, or customer reviews. Actively listen to your customers’ voices, address their concerns, and use their feedback to enhance your product, service, or overall customer experience.

5.4 Minimizing involuntary churn

Involuntary churn occurs when customers’ subscriptions are canceled due to issues with payment processing, expired cards, or failed transactions. Minimize involuntary churn by implementing proactive monitoring of payment failures, sending automated reminders to update payment information, and offering alternative payment options. By actively managing payment issues, you can reduce the risk of involuntary churn and maintain a healthy subscriber base.

6. Scaling your business with recurring billing

6.1 Scalability considerations for recurring billing

As your business grows, it’s important to ensure that your recurring billing system can scale alongside it. Consider factors such as the ability to handle a growing customer base, increased transaction volume, and international expansion. Choose a payment processor and recurring billing solution that can accommodate your future needs and support your business’s growth without compromising performance or security.

6.2 Automating processes and workflows

Automation plays a vital role in scaling your business with recurring billing. Implement automated processes and workflows to streamline repetitive tasks, such as invoice generation, payment collection, and subscription management. This not only improves efficiency but also reduces the chances of human error and frees up valuable time and resources for more strategic initiatives.

6.3 Leveraging data and analytics

Utilize data and analytics to gain insights into customer behavior, preferences, and trends. By leveraging data from your recurring billing system, you can identify opportunities for growth, optimize marketing campaigns, and make informed business decisions. Invest in analytics tools and create customized dashboards to track key performance indicators, providing valuable insights for strategic planning and business expansion.

6.4 Expanding into new markets

Recurring billing offers the opportunity to expand your business globally. When venturing into new markets, consider local payment preferences, currencies, and regulations. Research the specific needs and preferences of customers in each target market and adapt your pricing, offering, and marketing strategies accordingly. By catering to diverse markets, you can unlock new growth opportunities and increase your reach.

7. Overcoming challenges and risks

7.1 Handling failed payments and declined cards

Failed payments and declined cards are inevitable challenges when dealing with recurring billing. Implement strategies to minimize the frequency of failed payments and have clear processes in place to handle these situations efficiently. This may involve automated retry attempts, notifications to customers, and proactive customer outreach to update payment information.

7.2 Dealing with subscription cancellations

Subscription cancellations are a natural part of any business with recurring billing. When faced with cancellations, view it as an opportunity to gather feedback and understand the underlying reasons. Make the cancellation process user-friendly and offer options for customers to provide feedback, allowing you to address any issues and improve your offerings for future customers.

7.3 Addressing billing disputes and chargebacks

Billing disputes and chargebacks can be a source of frustration and financial loss. Establish clear policies and protocols for handling billing disputes, train your customer support team accordingly, and maintain accurate records of all transactions. Actively engage with customers to resolve disputes promptly and maintain open channels of communication to minimize the likelihood of chargebacks.

7.4 Mitigating fraud risk

Recurring billing systems are susceptible to fraud, which can result in financial losses and damage to your reputation. Implement robust fraud prevention measures, such as address verification systems, card security codes, and fraud monitoring tools. Regularly monitor transaction patterns, suspicious activities, and chargeback ratios to identify and mitigate potential fraud risks effectively.

8. Best practices for recurring billing

8.1 Keeping customer payment information up-to-date

To ensure a smooth billing experience, regularly remind customers to update their payment information, especially when cards are about to expire. Implement automated notifications via email or SMS well in advance, providing clear instructions on how to update payment details. By staying proactive in keeping customer information up-to-date, you can minimize disruptions in the billing process and maintain a healthy subscriber base.

8.2 Delivering an exceptional billing experience

A positive billing experience can greatly influence customer satisfaction and retention. Ensure that your invoices and billing notifications are clear, concise, and user-friendly. Avoid confusing jargon or complicated billing terms. Provide easy-to-understand breakdowns of charges, payment due dates, and any applicable taxes or fees. Additionally, offer different payment methods and flexibility in payment processing to cater to diverse customer preferences.

8.3 Regularly reviewing and optimizing billing processes

Continuously review and optimize your billing processes to identify areas for improvement. Regularly analyze customer feedback, measure key performance indicators, and conduct internal audits of your recurring billing system. Use this information to streamline processes, reduce errors, and enhance the overall billing experience. Regularly update systems, keeping up with the latest technologies and industry best practices.

8.4 Staying compliant with legal and regulatory requirements

Compliance with legal and regulatory requirements is crucial for maintaining trust and credibility with your customers. Stay informed about applicable laws and regulations, especially those related to data privacy and security. Invest in security measures that align with industry standards and ensure that customer data is stored and processed securely. Regularly review your compliance protocols and conduct audits to mitigate any potential risks and maintain compliance.

9. Case studies of successful businesses

9.1 Company A: How recurring billing drove growth

In the case of Company A, implementing recurring billing transformed their business model and drove remarkable growth. By offering subscription-based services and utilizing tiered pricing, they attracted a broad range of customers and achieved consistent revenue streams. Through regular communication, personalized offers, and exceptional customer support, Company A successfully retained their customers and expanded their subscriber base.

9.2 Company B: Overcoming challenges with recurring billing

Company B faced challenges with involuntary churn and failed payments. However, by implementing automated retry attempts, proactive communication with customers, and alternative payment options, they significantly reduced involuntary churn and improved their cash flow. By addressing customer concerns, optimizing their billing processes, and leveraging data analytics, Company B successfully navigated these challenges and achieved sustainable growth.

9.3 Company C: Scaling internationally with recurring billing

Company C utilized recurring billing as a key strategy for scaling internationally. By conducting market research, understanding local payment preferences, and adhering to regulatory requirements, they successfully expanded their services into new markets. Through customization, localization, and targeted marketing campaigns, Company C captured the attention of international customers, increased their market share, and established a global presence.

10. Future trends and innovations

10.1 AI and machine learning in recurring billing

Artificial intelligence (AI) and machine learning (ML) are revolutionizing recurring billing processes. AI-powered chatbots can enhance customer support by providing instant responses to inquiries and automating routine tasks. ML algorithms can analyze vast amounts of data to identify patterns, predict customer behavior, and optimize pricing strategies.

10.2 Subscription box services and business models

Subscription box services have gained significant popularity in recent years. These models offer curated products or experiences delivered to customers on a recurring basis. The convenience, surprise, and personalization of subscription boxes have attracted a loyal customer base, presenting new opportunities for businesses to diversify their revenue streams.

10.3 Blockchain technology for secure billing

Blockchain technology has the potential to revolutionize the security and transparency of recurring billing systems. By utilizing decentralized ledgers and smart contracts, businesses can enhance data security, reduce fraud, and provide customers with greater control over their payment information. Blockchain-based billing systems can also streamline cross-border transactions and eliminate the need for intermediaries.

10.4 Personalization and customization in recurring billing

Personalization and customization are increasingly important in recurring billing. Businesses can leverage customer data and preferences to tailor offerings, pricing, and billing terms to individual customers. By providing personalized experiences and addressing specific needs, businesses can increase customer satisfaction, loyalty, and ultimately, revenue.

In conclusion, recurring billing is a powerful tool for scaling your business and building long-term customer relationships. By understanding the fundamentals, implementing best practices, and leveraging innovative solutions, businesses can optimize their revenue, minimize churn, and stay ahead in a competitive market. As the future of billing continues to evolve, it’s important to stay agile, adapt to emerging trends, and deliver exceptional billing experiences to customers.

Leave a Reply