In this article, we will explore the future of payment processing and dive into the advancements of virtual terminals in 2023 and beyond. As technology continues to evolve and reshape various industries, the field of payment processing is no exception. Virtual terminals offer a convenient and secure alternative to traditional payment methods, enabling businesses to streamline their operations and enhance customer experiences. Join us as we take a closer look at the potential benefits and implications of virtual terminals in the years to come.

Advancements in Virtual Terminal Technology

Introduction to virtual terminals

Virtual terminals are a crucial component of modern payment processing systems, allowing businesses to accept payments remotely without the need for physical card terminals. With the rapid evolution of technology, virtual terminals have seen significant advancements in recent years, revolutionizing the way transactions are conducted. In this article, we will explore the current state of virtual terminal technology, emerging trends, and the potential future innovations that will shape the payment processing landscape.

Current state of virtual terminal technology

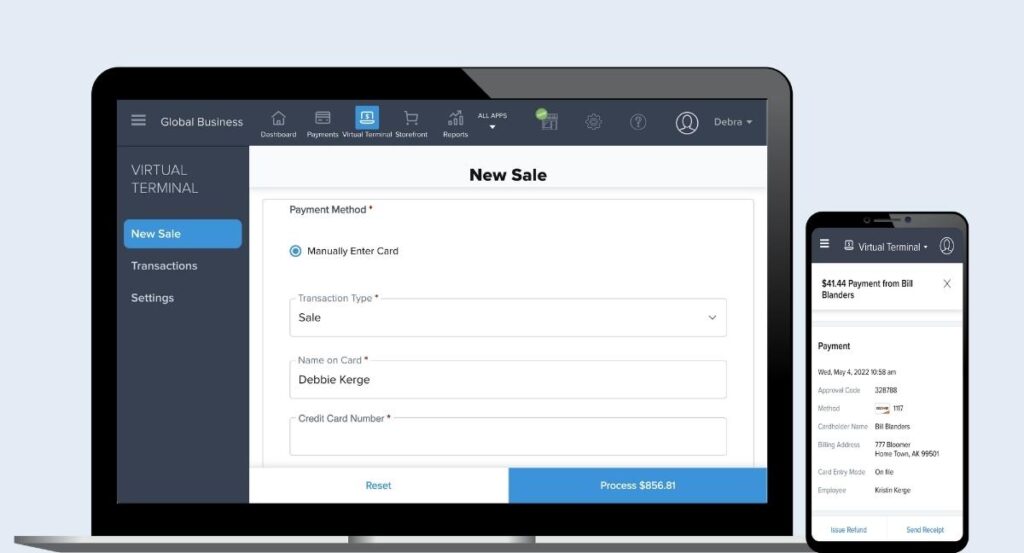

Virtual terminal technology has come a long way since its inception. Initially, virtual terminals were primarily web-based applications that required businesses to manually input customer payment details. However, technological advancements have made virtual terminals more intuitive and user-friendly. Modern virtual terminals now offer seamless integration with various payment channels, including credit/debit cards, mobile wallets, and cryptocurrencies. They provide businesses with a convenient and secure method to process payments, regardless of their location.

Emerging trends in virtual terminal technology

The payment processing industry is constantly evolving, and virtual terminals are at the forefront of these advancements. Several emerging trends are shaping the future of virtual terminal technology:

Enhanced Security Measures

Importance of secure payment processing

In today’s digital age, security is a top concern for businesses and consumers. With the exponential increase in online transactions, ensuring secure payment processing has become paramount. Virtual terminals offer various security measures to protect sensitive customer data and mitigate fraud risks. Implementing robust security protocols and adhering to industry standards such as Payment Card Industry Data Security Standard (PCI-DSS) ensures that payment information is encrypted and stored securely.

The role of encryption and tokenization

Encryption and tokenization play a vital role in securing payment transactions. Encryption ensures that sensitive data is encoded during transmission, minimizing the risk of unauthorized access. Tokenization, on the other hand, replaces sensitive information with unique tokens, making it virtually impossible for hackers to retrieve the original data. By utilizing encryption and tokenization techniques, virtual terminals can provide businesses and customers with an additional layer of security.

The impact of biometric authentication

Biometric authentication is gaining prominence in the payment processing industry, and virtual terminals are no exception. By using unique biological characteristics such as fingerprints or facial recognition, biometric authentication adds an extra level of security. With biometric authentication integrated into virtual terminals, businesses can ensure that only authorized individuals can access sensitive payment information, reducing the risk of fraudulent activities.

Utilization of blockchain technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, has also found its way into virtual terminal technology. The decentralized nature of blockchain provides enhanced security and transparency in payment transactions. By implementing blockchain technology, virtual terminals can offer immutable and traceable payment records, reducing the likelihood of fraud. Furthermore, blockchain’s ability to facilitate fast and secure cross-border transactions makes it an attractive solution for international payments.

The Rise of Mobile Payments

Overview of mobile payment solutions

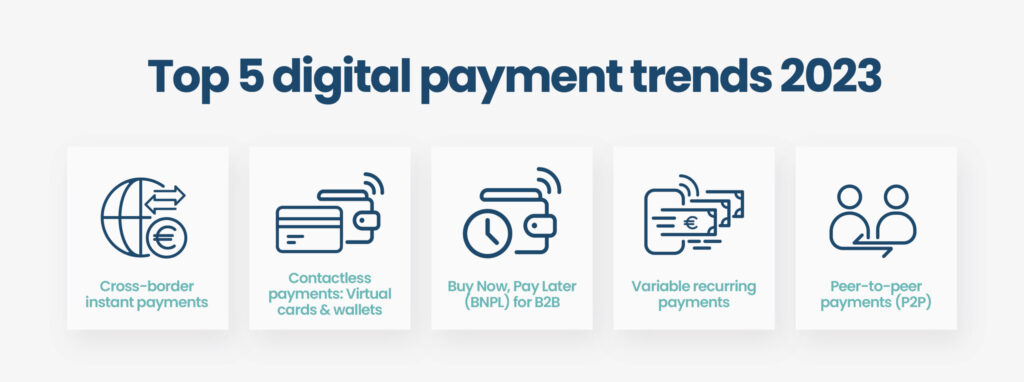

Mobile payments have experienced exponential growth in recent years, thanks to the ubiquity of smartphones and the convenience they offer. Virtual terminals have seamlessly integrated with mobile payment solutions, allowing businesses to accept payments through mobile wallets like Apple Pay, Google Pay, and Samsung Pay. These mobile payment solutions enable customers to make payments using their smartphones, eliminating the need for physical cards or cash.

Advantages for businesses and consumers

The rise of mobile payments through virtual terminals brings numerous advantages for both businesses and consumers. For businesses, accepting mobile payments allows them to cater to the evolving needs and preferences of their customers, unlocking new revenue streams. It simplifies the checkout process, reducing friction and increasing conversion rates. On the other hand, consumers benefit from the convenience and simplicity of mobile payments, enabling them to make purchases with just a few taps on their smartphones. Mobile payments offer a secure and contactless option, particularly relevant in the wake of the COVID-19 pandemic.

Integration of virtual terminals with mobile wallets

To stay ahead in this mobile-driven era, virtual terminals have seamlessly integrated with mobile wallets. This integration expedites the payment process by eliminating the need for customers to manually enter their payment information. With a simple tap, customers can authorize payments through their mobile wallets, making the transaction process swift and seamless. Such integration creates a frictionless experience for customers, improving overall satisfaction and encouraging repeat business.

Future of contactless payments

Contactless payments have rapidly gained popularity in recent years, and virtual terminals are well-positioned to adapt to this trend. With the growth of near field communication (NFC) technology, contactless payments have become more accessible and secure. Virtual terminals equipped with NFC capabilities enable businesses to accept payments from customers’ contactless cards or smartphones, enhancing convenience and reducing physical contact. The future of contactless payments is expected to witness further innovations, such as wearable devices and biometric authentication, making transactions even faster and more seamless.

Integration with Artificial Intelligence

Utilizing AI for fraud prevention

Artificial Intelligence (AI) has transformed various industries, and payment processing is no exception. AI-powered fraud detection systems analyze vast amounts of transaction data in real-time, flagging suspicious activities and reducing false positives. By leveraging machine learning algorithms, virtual terminals can continuously improve their ability to detect and prevent fraudulent transactions, bolstering security and trust in the payment ecosystem.

AI-powered chatbots for customer support

Virtual terminals can also integrate AI-powered chatbots to enhance customer support. These automated chatbots can provide prompt and personalized assistance to customers, answering frequently asked questions, resolving issues, and guiding users through the payment process. By leveraging natural language processing and machine learning, AI chatbots can offer a seamless user experience and alleviate the burden on customer service teams.

Data analysis and predictive modeling

The vast amount of transaction data processed through virtual terminals presents an opportunity for businesses to gain valuable insights. AI algorithms can analyze this data, identifying patterns and trends that help businesses optimize their operations and make informed decisions. Additionally, predictive modeling can anticipate customer behavior, enabling businesses to personalize their offerings and marketing strategies.

Personalization and recommendation engines

AI-powered recommendation engines have become commonplace in industries like e-commerce, and virtual terminals are leveraging this technology to enhance the customer experience. By analyzing customer purchase history and preferences, virtual terminals can provide personalized product recommendations and tailored offers, increasing customer engagement and driving sales. Personalization fosters brand loyalty and cultivates long-term customer relationships, contributing to the growth and success of businesses.

Streamlining Business Operations

Automated invoice generation and tracking

Virtual terminals can streamline business operations by automating invoice generation and tracking. With virtual terminals, businesses can generate electronic invoices and easily track their status, payments, and late fees. This automation eliminates the need for manual paperwork and reduces administrative overhead, allowing businesses to focus on core operations.

Integration with accounting software

To further enhance efficiency, virtual terminals can seamlessly integrate with accounting software, simplifying financial management processes. Such integration enables automatic synchronization of transaction data, reducing the chances of errors and improving accuracy. Businesses can generate real-time financial reports, analyze cash flow, and reconcile transactions effortlessly, enhancing overall productivity.

Efficient inventory management

Managing inventory effectively is crucial for businesses, and virtual terminals can contribute to this aspect as well. With the integration of virtual terminals and inventory management systems, businesses can automate inventory tracking, receive real-time updates on stock levels, and trigger reorder notifications. This integration streamlines the fulfillment process, reduces stockouts, and optimizes inventory levels, ensuring consistent availability of products.

Real-time reporting and analytics

Virtual terminals provide businesses with real-time reporting and analytics capabilities, offering valuable insights into sales performance, customer behavior, and revenue trends. These reports enable businesses to make data-driven decisions, identify areas for improvement, and formulate effective strategies. By analyzing transaction data, businesses can optimize pricing, promotions, and marketing campaigns, maximizing profitability and revenue growth.

Virtual Terminal Customization

Tailoring virtual terminals to specific industries

Different industries have distinct payment processing needs, and virtual terminals can be customized accordingly. Whether it’s the healthcare sector, retail, or hospitality, virtual terminals can be tailored to address industry-specific requirements. Customized virtual terminals offer specialized features, compliance measures, and integrations that cater specifically to the unique needs of each industry, ensuring seamless payment processing.

Customizable user interfaces

Virtual terminals can provide customizable user interfaces to accommodate the branding and user experience preferences of businesses. From logos and color schemes to personalized checkout fields, businesses can tailor the virtual terminal’s appearance to align with their brand identity. Customizable user interfaces not only enhance the customer experience but also contribute to building brand recognition and trust.

Integration with existing business systems

Businesses often rely on multiple software systems for various operational needs. Virtual terminals can integrate with existing business systems, such as customer relationship management (CRM), point of sale (POS), and inventory management software. This integration ensures smooth data flow between systems, eliminates redundant data entry, and enhances overall operational efficiency.

APIs for third-party integrations

Virtual terminals can leverage application programming interfaces (APIs) to facilitate seamless integration with third-party service providers. Whether it’s incorporating loyalty programs, online ordering platforms, or analytics tools, APIs enable businesses to extend the functionality of their virtual terminals. Such integrations enhance the customer experience and provide businesses with valuable insights and additional revenue streams.

Addressing Regulatory Compliance

Ensuring compliance with data protection regulations

Data protection has become a critical concern for businesses amidst the increasing stringency of regulations. Virtual terminals must comply with data protection regulations, such as the General Data Protection Regulation (GDPR), to safeguard customer data and avoid regulatory penalties. Implementing robust security measures, obtaining appropriate user consent, and adopting privacy-by-design principles are essential for ensuring compliance.

GDPR and its implications

The GDPR, implemented in the European Union, has had a profound impact on virtual terminals and payment processing as a whole. This regulation governs the processing and storage of personal data, emphasizing transparency and user rights. Virtual terminals must adhere to the GDPR’s requirements, such as obtaining explicit user consent, providing data breach notifications, and offering the right to be forgotten. Compliance with the GDPR enhances customer trust and strengthens data protection practices.

PCI-DSS standards for secure payment processing

Payment Card Industry Data Security Standard (PCI-DSS) outlines security standards for organizations that handle cardholder data. Virtual terminals must adhere to PCI-DSS requirements, such as the use of secure network connections, encryption, and regular vulnerability assessments. Compliance with PCI-DSS ensures secure payment processing and protects businesses and customers from potential data breaches.

Impact of global regulations on virtual terminals

While the GDPR is a major regulatory framework, virtual terminals also need to consider other regulations worldwide. Various countries and regions have enacted their own data protection and privacy laws, such as the California Consumer Privacy Act (CCPA) and Brazil’s General Data Protection Law (LGPD). Virtual terminals need to adapt to these regulations to ensure global compliance and maintain a high level of data protection standards.

International Expansion of Virtual Terminals

Challenges and opportunities for cross-border payments

Virtual terminals have opened doors for businesses seeking international expansion. However, cross-border payments come with challenges such as currency conversion, complex regulations, and varying payment preferences. Virtual terminals need to offer seamless cross-border payment solutions to address these challenges and provide an opportunity for businesses to enter new markets.

Currency conversion and exchange rate considerations

When expanding internationally, businesses face the task of managing currency conversion and exchange rates. Virtual terminals must provide reliable and transparent currency conversion services, ensuring accurate calculations and fair exchange rates. By offering competitive exchange rates and minimizing exchange rate risk, virtual terminals can facilitate international transactions and enhance customer satisfaction.

Localization and language support

Expanding into new markets requires virtual terminals to support localization and language preferences. Offering localized payment options, such as region-specific cards and alternative payment methods, enhances customer convenience and fosters trust. Similarly, providing multilingual support and localized user interfaces enables businesses to cater to customers from different regions, ensuring a seamless payment experience.

Managing global payment preferences

Different regions have distinct payment preferences, and virtual terminals need to accommodate these preferences. While credit and debit cards are widely used, some regions may prefer alternative payment methods like e-wallets, bank transfers, or digital currencies. Virtual terminals must offer a diverse range of payment options, catering to the preferences of customers in their target markets, and tailoring their offerings accordingly.

Impact of Virtual Terminals on E-commerce

Transitioning from physical to virtual storefronts

E-commerce has witnessed exponential growth in recent years, prompting businesses to transition from physical storefronts to online platforms. Virtual terminals play a pivotal role in facilitating this transition, enabling businesses to accept payments seamlessly in the digital realm. Regardless of their industry or scale, businesses can leverage virtual terminals to establish an online presence and capitalize on the growing e-commerce market.

Seamless integration with online shopping platforms

Virtual terminals seamlessly integrate with online shopping platforms, enabling businesses to offer a smooth and streamlined checkout experience for customers. From integrating payment buttons on their websites to linking virtual terminals with shopping cart systems, businesses can optimize the online purchasing journey. Such integration ensures secure payments, reduces cart abandonment rates, and enhances the overall customer experience.

Enhancing customer experience in online transactions

Customer experience is a game-changer in e-commerce, and virtual terminals contribute to enhancing this aspect. By providing a secure and user-friendly payment experience, virtual terminals instill confidence and satisfaction in customers. Additionally, features like one-click payments, saved payment information, and personalized payment options elevate the convenience and speed of online transactions, contributing to customer loyalty and repeat business.

Competitive advantages of virtual terminal adoption

Small and medium-sized enterprises (SMEs) often face challenges in establishing online payment capabilities. Virtual terminals level the playing field, allowing SMEs to compete with larger establishments. By adopting virtual terminals, businesses can offer secure payment processing, improve operational efficiency, and provide a seamless checkout experience. Virtual terminals offer scalability, flexibility, and cost-effectiveness, empowering businesses to succeed in the fiercely competitive e-commerce landscape.

Future Innovations and Possibilities

Exploring biometric payment authentication

As technology continues to advance, biometric payment authentication holds immense potential. Virtual terminals can leverage biometric data such as fingerprints, facial recognition, or even iris scans to authenticate transactions. This technology enhances security, eliminates the need for passwords, and facilitates rapid and seamless payment processing.

Integration of virtual reality in payment processing

Virtual reality (VR) has made significant strides in various industries, and its integration into payment processing is an exciting possibility. Virtual terminals could utilize VR to create immersive and interactive payment experiences, allowing customers to visualize products before making a purchase. The incorporation of VR in payment processing can revolutionize customer engagement and further bridge the gap between physical and virtual shopping experiences.

Voice-activated virtual terminals

Voice-activated technology, driven by artificial intelligence, is becoming increasingly prevalent in our daily lives. Virtual terminals can harness voice recognition capabilities, allowing customers to make payments through voice commands. This technology offers a hands-free and convenient payment method, particularly suitable for smart home devices, virtual assistants, and connected vehicles.

Internet of Things (IoT) and connected devices

The Internet of Things (IoT) is a rapidly growing ecosystem of connected devices, and virtual terminals can integrate seamlessly within this environment. Imagine making payments directly from your smart refrigerator or wearable devices. Virtual terminals can leverage IoT to offer frictionless payments and enable seamless access to services, making everyday transactions more convenient and efficient.

The future of payment processing is exciting, and virtual terminals are poised to play a prominent role in shaping this landscape. Through enhanced security measures, seamless integration with mobile payments, collaboration with artificial intelligence, streamlining business operations, customization options, regulatory compliance, international expansion, and pushing the boundaries of innovation, virtual terminals are set to revolutionize the way businesses and consumers conduct financial transactions. As technology continues to evolve, the possibilities for virtual terminal technology are limitless, promising a transformative and revolutionary future in payment processing.

Leave a Reply