If you’re running a business and considering using Toast POS as your point of sale system, you’re probably wondering about the costs involved. This article will provide you with the information you need, specifically focusing on how much Toast POS charges per transaction. By the end, you’ll have a clear understanding of the fees associated with using this popular POS system, allowing you to make an informed decision for your business.

Toast POS Pricing Overview

Welcome to our comprehensive article about Toast POS pricing! If you’re considering Toast POS for your business, it’s important to understand the various costs involved. In this article, we will break down the different aspects of Toast POS pricing, including transaction fees, hardware costs, software costs, and integration fees. By the end, you’ll have a clear understanding of the expenses associated with using Toast POS and be able to determine the right plan for your business.

Toast POS Transaction Fees

When it comes to transaction fees, Toast POS offers a straightforward pricing structure. They charge a flat rate per transaction, making it easy to calculate the cost for each sale. Additionally, Toast POS includes additional fees for online orders, which is essential for businesses that rely on digital sales channels. It’s important to note that credit card processing fees are also part of the transaction fees, as Toast POS acts as the gateway for your payments.

Toast POS Hardware Costs

In terms of hardware costs, there are a few factors to consider. The initial setup and equipment costs cover the necessary devices and infrastructure needed to run Toast POS smoothly. This includes items such as terminals, cash drawers, and receipt printers. While these costs may seem significant initially, they are essential for providing a seamless experience for both your staff and customers. Toast POS also offers optional POS hardware components that can enhance functionality, such as kitchen display systems or handheld tablets for tableside ordering. Lastly, there are support and maintenance fees to consider, which ensure that your hardware is well-maintained and promptly supported in case of any issues.

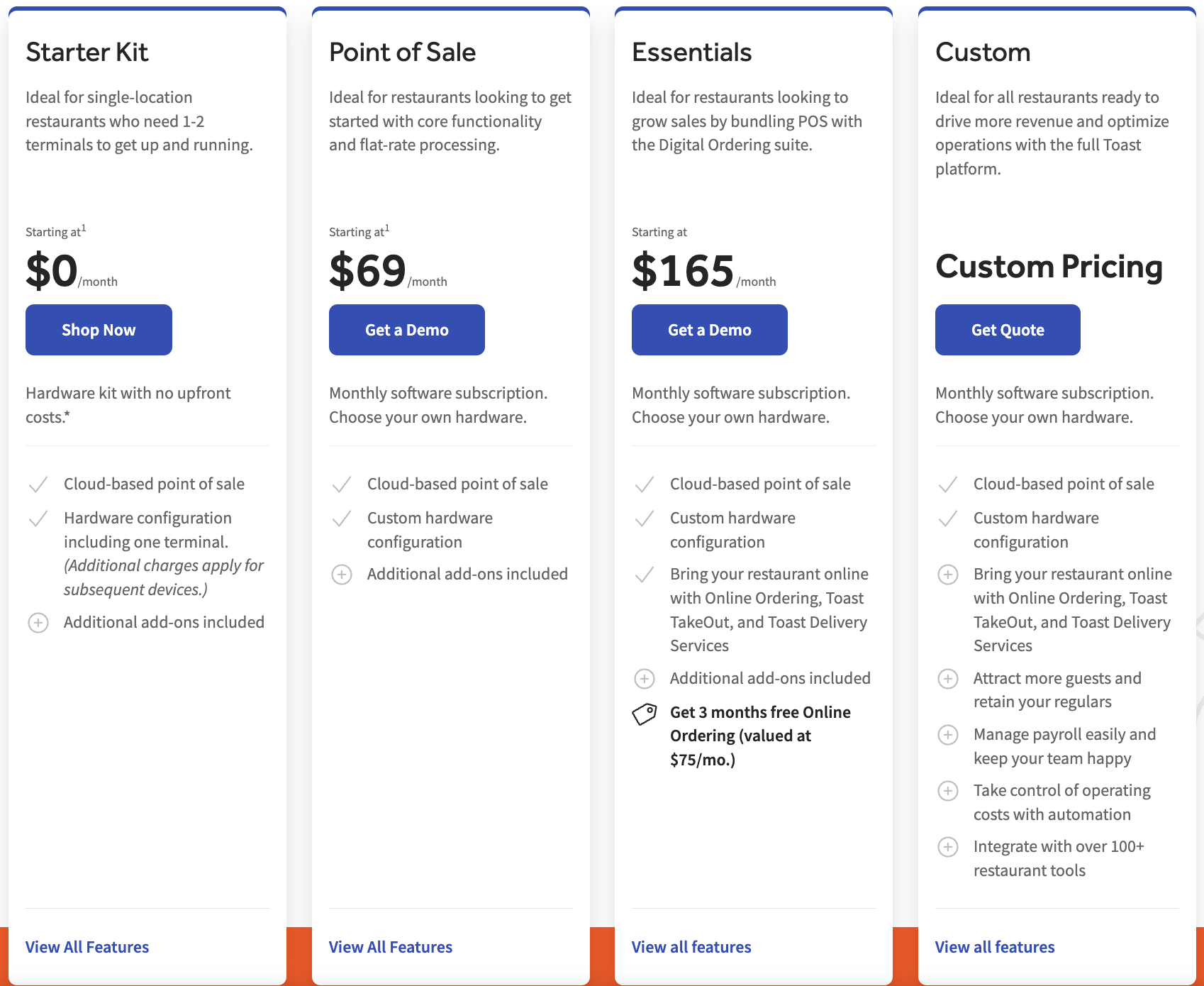

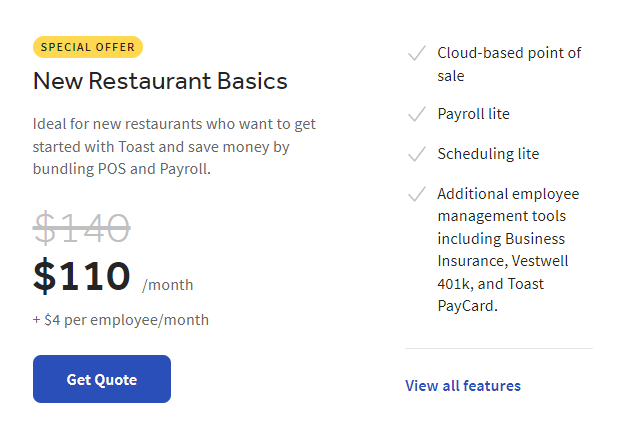

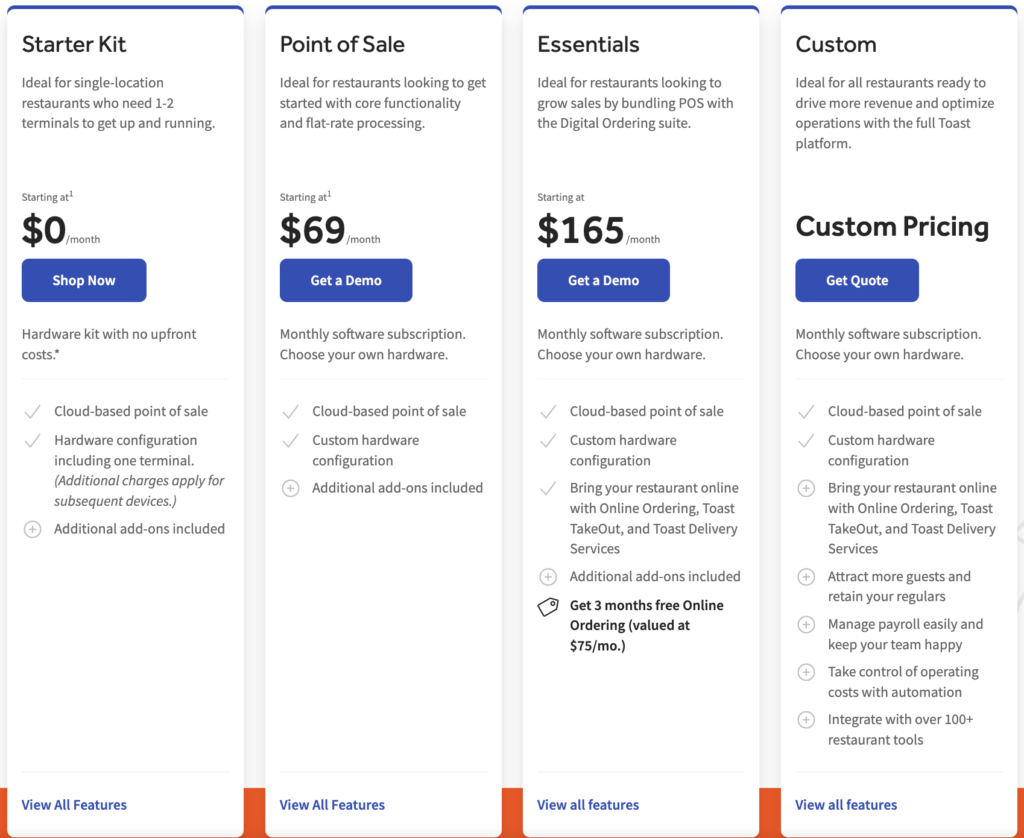

Toast POS Software Costs

Toast POS operates on a monthly or annual subscription basis for its software. The software subscription cost varies depending on the size of your business and specific needs. Toast POS offers different pricing tiers that cater to various business sizes, allowing you to choose the one that best suits your requirements. It’s important to consider that there may be additional fees for advanced features that may be essential for your business operations. These fees are worth considering to optimize the functionality of Toast POS and streamline your business processes.

Toast POS Integration Fees

Integration fees cover the costs associated with connecting Toast POS to third-party software. This integration allows you to synchronize data across different platforms and streamline your operations. While Toast POS provides seamless integration with many popular tools, there may be additional charges for custom integrations. If your business requires specific integrations that aren’t offered out-of-the-box, it’s crucial to factor in these costs when evaluating the overall expenses of using Toast POS.

Factors Affecting Toast POS Transaction Charges

Several factors can influence the transaction charges you’ll incur when using Toast POS. The type of business you operate plays a significant role in determining these costs. Whether you run a small café or a high-volume restaurant, the transaction fees will vary accordingly. Additionally, the volume of transactions your business handles can impact the overall charges. Toast POS offers tailored solutions for businesses with different transaction volumes, allowing you to find the best fit for your needs. Lastly, the average transaction size should be taken into account when calculating Toast POS transaction charges, as it can affect the flat-rate fees associated with each sale.

Comparing Toast POS Pricing to Competitors

To fully understand Toast POS pricing, it’s helpful to compare it to its competitors. Square POS is a well-known provider in the market, offering competitive pricing options. Shopify POS is another popular choice, especially for businesses with strong e-commerce integration needs. Clover POS is also worth considering, known for its versatility and robust features. By comparing Toast POS pricing to these competitors, you can assess the value and affordability of each option and make an informed decision.

Understanding Toast POS Pricing Structure

Toast POS takes pride in its transparent pricing structure. They aim to give businesses a clear understanding of the costs involved and avoid any hidden fees. However, it’s always wise to watch out for potential hidden costs that could arise during your usage of the platform. While unlikely with Toast POS, it’s essential to be aware of any additional charges that may appear, such as fees for specific support services or hardware upgrades. Staying vigilant and regularly reviewing your expenses will help you avoid any surprises.

Negotiating pricing with Toast POS is also an option worth exploring. Depending on your business size and unique circumstances, Toast POS may be open to discussing customized pricing plans. Engage in a conversation with their sales team, clearly expressing your requirements and budget constraints. They may be able to offer you a more tailored pricing package that fits your needs, allowing for a more cost-effective solution.

Determining the Right Toast POS Plan for Your Business

To determine the right Toast POS plan for your business, it’s crucial to analyze your specific needs. Start by evaluating your business’s requirements and identifying the key features and functionalities you need from a POS system. Consider factors such as the type of establishment, the number of employees, and the volume of transactions you expect to process. Your business’s growth projections should also be taken into account to ensure scalability. By carefully assessing these factors, you can choose the most suitable Toast POS plan that aligns with your current needs and allows for future expansion.

Conclusion

In conclusion, understanding Toast POS pricing is essential for making an informed decision about whether it’s the right POS system for your business. By considering transaction fees, hardware costs, software costs, and integration fees, you can get a comprehensive overview of the expenses involved. Additionally, analyzing factors such as business type, transaction volume, and average transaction size will help you gauge the impact of Toast POS transaction charges on your overall operations. Finally, comparing Toast POS pricing to its competitors and understanding the pricing structure and potential hidden costs will enable you to make a well-informed decision. With careful consideration of your business needs and growth projections, you can determine the right Toast POS plan that best suits your requirements.

Leave a Reply