In this article, we will explore the hidden truths behind reliable merchant services and credit card processing. Whether you are a Detroit retail merchant or simply curious about the industry, we have gathered valuable insights to help you navigate the complex world of payment processing. From debunking common misconceptions to uncovering the secrets behind trustworthy providers, we aim to shed light on this crucial aspect of business operations. So, fasten your seatbelt and get ready to uncover the truth that will empower you in your pursuit of reliable merchant services and seamless credit card processing.

Understanding Merchant Services

Definition of merchant services

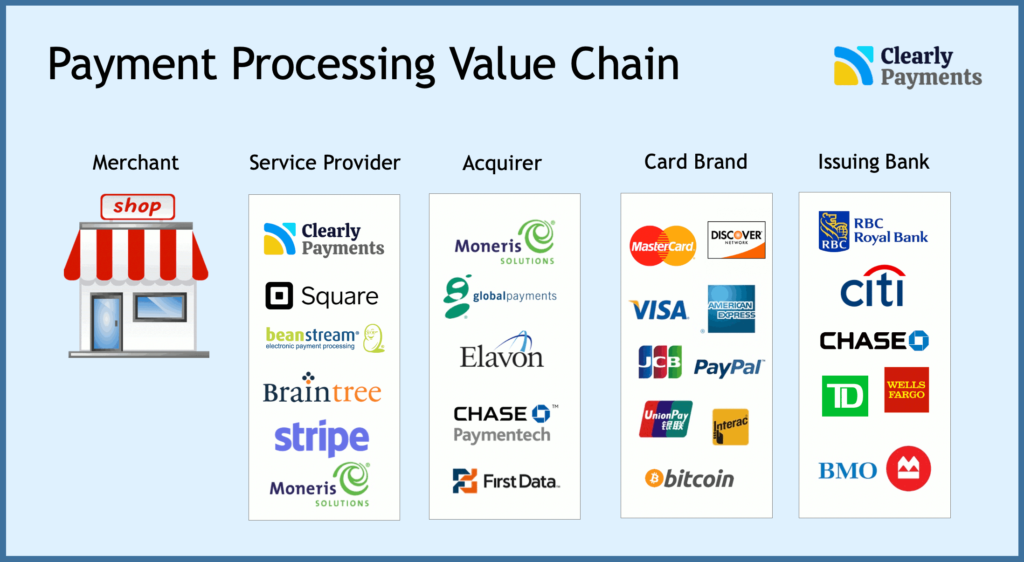

Merchant services refer to a range of financial services that enable businesses to accept and process electronic payments, primarily credit and debit card transactions. These services are provided by merchant service providers, also known as payment processors or acquirers, who act as intermediaries between the business and the credit card networks.

Importance of merchant services for businesses

Merchant services play a crucial role in today’s business landscape. By accepting credit and debit card payments, businesses can attract more customers and increase sales. In an increasingly cashless society, offering convenient payment options is essential for customer satisfaction and retention. Merchant services also provide businesses with the ability to securely process transactions, manage payment data, and track sales activity.

Types of merchant services

Merchant services encompass a variety of offerings to meet the diverse needs of businesses. These services may include credit card processing, payment gateway integration, mobile payments, e-commerce solutions, virtual terminals, and point-of-sale (POS) systems. Each type of service serves a specific purpose, allowing businesses to tailor their payment processing capabilities to their unique requirements.

The Basics of Credit Card Processing

What is credit card processing?

Credit card processing involves the steps necessary to authorize and complete a transaction made with a credit or debit card. It typically consists of three main stages: authorization, settlement, and funding. During the authorization stage, the customer’s card information is verified to ensure they have sufficient funds available. Once authorized, the settlement process transfers the funds from the customer’s account to the merchant’s account. Finally, the funding stage disburses the funds to the merchant’s bank account.

Why businesses need credit card processing

Credit card processing is a fundamental aspect of modern commerce. Accepting credit and debit card payments provides businesses with a competitive advantage, as it allows them to accommodate the preferences of their customers. Furthermore, credit card processing enables businesses to streamline their payment processes, reduce the risk of cash handling errors, and enhance cash flow management.

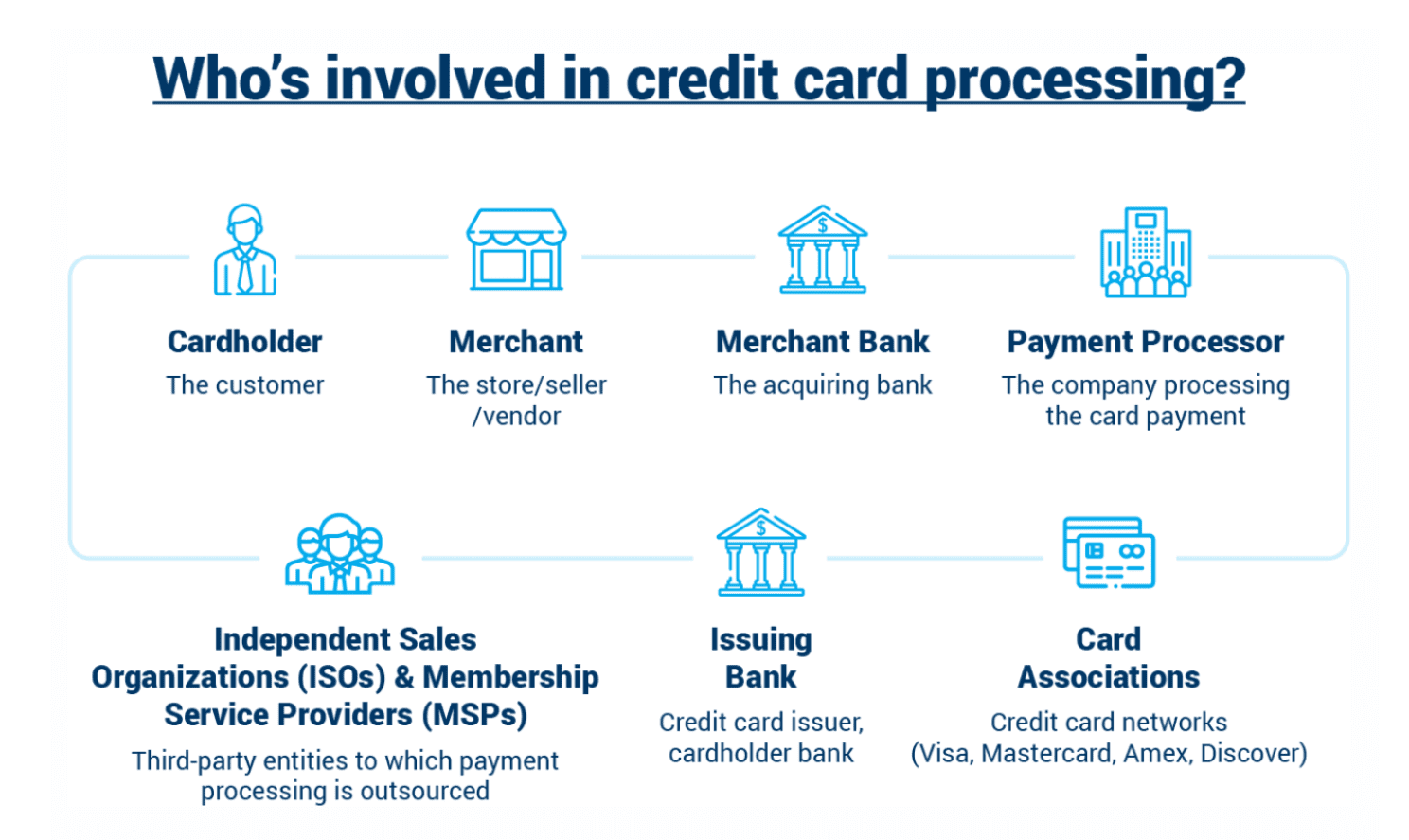

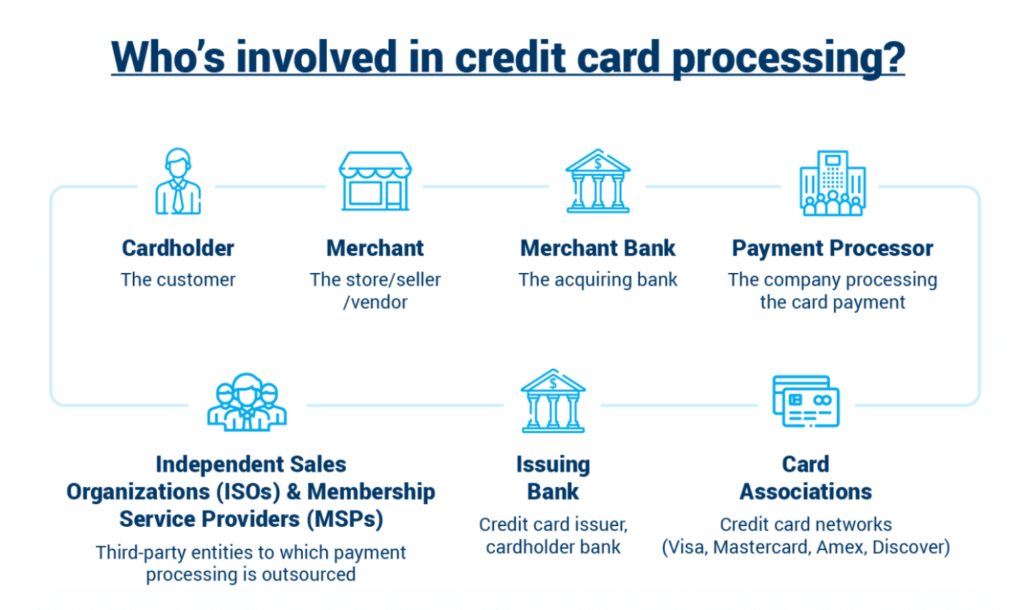

How credit card processing works

Credit card processing involves multiple entities working together seamlessly. When a customer makes a purchase, their card information is securely transmitted to the merchant’s payment gateway, either via point-of-sale terminal or online platform. The payment gateway then communicates with the credit card network to verify the transaction details and ensure the customer has sufficient funds. Once authorized, the transaction is settled, and the funds are transferred to the merchant’s account. The entire process takes mere seconds, ensuring a smooth and efficient customer experience.

Factors to Consider in Choosing Reliable Merchant Services

Security and fraud prevention measures

One of the critical factors to consider when choosing merchant services is the security and fraud prevention measures implemented by the provider. Look for features such as encryption to protect sensitive cardholder data, tokenization to replace card information with unique tokens, and fraud detection systems that analyze transaction patterns for suspicious activity. Additionally, ensure the provider is Payment Card Industry Data Security Standard (PCI DSS) compliant, as this certification guarantees adherence to industry-wide security standards.

Customer support and service availability

Reliable merchant service providers should offer excellent customer support and ensure their services are available whenever you need them. Look for providers that offer 24/7 customer support through multiple channels, such as phone, email, or live chat. Prompt and knowledgeable assistance is crucial for addressing any issues that may arise during payment processing, ensuring minimal disruption to your business operations.

Processing fees and rates

Evaluate the processing fees and rates offered by different merchant service providers carefully. While the fees may vary, it is essential to understand the fee structure and any additional charges associated with specific transactions or services. Consider providers that offer transparent pricing models with competitive rates, ensuring you get the most value for your money.

Compatibility with business type and size

Consider your business’s specific needs and choose a merchant service provider that specializes in serving your industry. Different businesses have unique requirements, such as retail stores needing point-of-sale terminals or e-commerce businesses requiring online payment solutions. Additionally, consider the scalability of the provider’s services, ensuring they can accommodate your business’s growth.

Integration with other systems and software

To streamline your operations, choose a merchant service provider that offers seamless integration with your existing systems and software. This compatibility allows for automatic transfer and updating of transaction data, reducing manual data entry and the chance of errors. Integration can also help streamline inventory management, accounting processes, and customer relationship management, enhancing overall efficiency.

Understanding Payment Gateways

Definition of payment gateways

A payment gateway serves as a bridge between the merchant’s website or point-of-sale system and the credit card networks. It securely transmits transaction data between these entities, ensuring the authorization and settlement of the payment. The payment gateway acts as a virtual terminal, encrypting sensitive information such as the customer’s card details and transmitting it securely to the payment processor for further processing.

How payment gateways facilitate credit card processing

Payment gateways facilitate the flow of information required for credit card processing. When a customer makes a purchase, the payment gateway securely collects and encrypts the transaction details, including the customer’s card information. It then transmits this encrypted data to the payment processor, which communicates with the appropriate credit card network to authorize and settle the transaction. The payment gateway plays a vital role in ensuring the security and smooth flow of data throughout the payment process.

Different types of payment gateways

Payment gateways come in various forms to cater to different business needs. Hosted payment gateways redirect customers to a secure payment page hosted by the payment gateway provider, ensuring the merchant’s website remains free from handling sensitive payment information. Integrated payment gateways, on the other hand, allow customers to complete their transactions without leaving the merchant’s website, enhancing the user experience.

Key Features of Reliable Merchant Services

Secure data transmission and storage

Reliable merchant service providers prioritize the security of your data, implementing robust encryption to ensure sensitive information is transmitted and stored securely. Look for providers that support SSL/TLS encryption to protect cardholder data during transmission. Similarly, providers offering secure storage solutions, such as tokenization, minimize the risk of data breaches and enhance overall security.

Multiple payment options

Choose a merchant service provider that offers a wide range of payment options to cater to your customers’ preferences. Besides accepting major credit and debit cards, consider providers that support alternative payment methods such as mobile wallets, digital currencies, or installment payment plans. Offering diverse payment options ensures your business can accommodate customers with different preferences and purchasing habits.

Recurring billing and subscription management

If your business relies on recurring billing or subscription models, ensure the merchant service provider offers robust tools for managing these processes. Look for features that automate recurring payments, send reminders to customers, and provide detailed reporting on subscription revenue. Such capabilities simplify subscription management, improve customer satisfaction, and optimize revenue tracking.

Multi-currency capabilities

For businesses operating in international markets, consider a merchant service provider that supports multi-currency capabilities. This functionality allows you to accept payments in different currencies and simplifies the conversion process. With multi-currency capabilities, you can expand your customer base, reach global markets, and potentially increase revenue.

Real-time transaction reporting

Access to real-time transaction reporting allows you to monitor sales activity, identify trends, and make informed business decisions. Look for merchant service providers that offer comprehensive reporting features, including transaction details, settlement status, chargeback notifications, and reconciliation reports. The ability to track and analyze your payment data in real-time empowers you to optimize your business operations and improve financial management.

Mobile payment integration

In today’s mobile-driven world, it is essential to choose a merchant service provider that offers seamless mobile integration. With the increasing popularity of mobile payments, an integrated mobile payment solution enables businesses to accept payments through smartphones and tablets, whether in-store or online. This convenience enhances the customer experience, encourages impulse purchases, and boosts sales.

The Importance of Security in Credit Card Processing

Common security threats in credit card processing

Credit card processing can be susceptible to various security threats, such as data breaches, hacking, and identity theft. Criminals may attempt to steal customers’ card information or hijack the payment processing system to carry out fraudulent transactions. It is crucial for businesses to implement robust security measures and stay vigilant against these threats to protect both their customers and their reputation.

PCI DSS compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is a set of security standards established by the major card networks to ensure the protection of cardholder data. Compliance with these standards is mandatory for businesses that handle credit card transactions. It involves implementing various security measures, such as secure networks, encryption, access controls, and regularly monitoring and testing systems to detect vulnerabilities and prevent breaches.

Encryption and tokenization technologies

Encryption and tokenization technologies are essential components of credit card processing security. Encryption involves scrambling sensitive data, such as cardholder information, using complex algorithms to render it useless if intercepted by unauthorized individuals. Tokenization, on the other hand, replaces the actual card data with a unique token, which is used for transaction processing and storage. This ensures that even if the token is intercepted, it cannot be used to gain access to the original card data.

Fraud detection and prevention measures

Fraud detection and prevention tools are vital in safeguarding credit card transactions. These tools analyze transaction data in real time, looking for patterns or anomalies that indicate potential fraudulent activity. Suspicious transactions can then be flagged for further investigation or undergo additional authentication processes, such as two-factor authentication. By proactively identifying and preventing fraudulent transactions, businesses can minimize financial losses and protect their customers’ sensitive information.

Understanding Fees and Rates in Credit Card Processing

Different types of fees involved

Credit card processing involves various fees that businesses need to understand to accurately assess their costs. These fees may include interchange fees, assessment fees, and markup and processing fees. Interchange fees are charged by the card networks and represent a percentage of the transaction amount, while assessment fees are fees charged by the card networks for their services. Markup and processing fees, also known as merchant account fees, are charged by the merchant service provider for processing transactions and maintaining the merchant account.

Interchange fees

Interchange fees are determined by the card networks, such as Visa and Mastercard, and are non-negotiable for merchants. They vary based on factors such as the type of card used, the level of risk associated with the transaction, and the industry in which the merchant operates. Interchange fees are typically composed of a percentage of the transaction amount plus a flat fee, and they are paid to the card-issuing bank.

Assessment fees

Assessment fees are charges imposed by the card networks for their services and are expressed as a percentage of the transaction volume. These fees are non-negotiable and are paid directly to the card networks, such as Visa or Mastercard. Assessment fees contribute to card network operations, marketing, and other related expenses.

Markup and processing fees

Markup and processing fees are charges imposed by the merchant service provider for their services. These fees are negotiable and vary among providers. Markup fees are the provider’s profit margin, while processing fees cover the costs of processing transactions, maintaining the merchant account, and providing customer support. To ensure competitive pricing, it is essential to compare and negotiate these fees when selecting a merchant service provider.

Bundled vs. interchange plus pricing models

Merchant service providers typically offer two pricing models: bundled pricing and interchange plus pricing. Bundled pricing lumps all fees together into a single rate, simplifying the cost structure but potentially making it more challenging to determine the exact fees being charged. Interchange plus pricing, on the other hand, separates the interchange fee from the provider’s markup, allowing for greater transparency and potentially lower costs. Assess your business’s transaction volume and complexity to determine which pricing model is more cost-effective for your specific needs.

Negotiating rates with merchant service providers

Negotiating rates with merchant service providers is a common practice. Before entering into a contract, thoroughly research competing providers and compare their fee structures. Armed with this knowledge, you can negotiate for better rates or request waivers or reductions on certain fees. Consider factors such as your business’s transaction volume, industry, and growth potential when negotiating rates. Remember, a reliable merchant service provider should be willing to work with you to find mutually beneficial pricing arrangements.

How to Choose a Reliable Merchant Service Provider

Researching and comparing providers

Choosing a reliable merchant service provider requires thorough research and comparison. Start by identifying your business’s specific needs and objectives, such as the type of payments you want to accept and the volume of transactions you expect. Then, research providers that specialize in serving businesses similar to yours. Compare their offerings, pricing, security measures, and reputation to make an informed decision.

Reading customer reviews and testimonials

Customer reviews and testimonials provide valuable insights into the quality of service offered by merchant service providers. Look for reviews from businesses similar to yours, paying attention to factors such as customer support, reliability, and the overall customer experience. While no provider is immune to occasional negative feedback, a pattern of positive reviews can indicate a reliable and customer-focused provider.

Assessing customer support

Prompt and knowledgeable customer support is crucial when it comes to merchant services. Assess how quickly providers respond to customer inquiries, whether they offer 24/7 support, and the availability of multiple support channels. Consider reaching out to the provider with any questions you may have during the evaluation process to gauge their responsiveness and expertise.

Understanding contract terms and termination fees

Carefully review the contract terms and conditions before committing to a merchant service provider. Pay attention to factors such as contract length, termination fees, and any potential hidden charges. Ensure the contract aligns with your business’s needs and growth plans, and seek clarification on any ambiguous terms or conditions.

Evaluating technology and features

Consider the technology and features offered by each merchant service provider. Assess their payment gateway capabilities, integration options, reporting tools, and compatibility with your existing systems and software. Look for providers that offer user-friendly interfaces, customization options, and easy integration with your preferred e-commerce platform or point-of-sale system.

Considering scalability and growth potential

Choose a merchant service provider that can support the scalability and growth of your business. Your payment processing needs may evolve over time, and it is crucial to select a provider that can accommodate increased transaction volumes, additional payment options, and expanding market reach. Consider providers that offer flexible solutions and pricing models to ensure long-term compatibility and cost-effectiveness.

Common Challenges in Merchant Services & Credit Card Processing

Integration issues with existing systems

Integrating merchant services and credit card processing with existing systems can present challenges. Compatibility issues, data transfer complexities, and system stability concerns may arise. To mitigate these challenges, thoroughly assess the compatibility of potential merchant service providers with your existing systems and discuss integration possibilities with their technical support team before committing.

Payment disputes and chargebacks

Payment disputes and chargebacks are common challenges faced by businesses in credit card processing. Customers may dispute a transaction due to misunderstandings, dissatisfaction with products or services, or fraudulent activity. Chargebacks can be costly and time-consuming for businesses to resolve. Implement proactive measures to minimize the occurrence of chargebacks, such as clear refund policies, detailed transaction documentation, and efficient customer support to address customer concerns promptly and effectively.

Data breaches and security risks

Data breaches and security risks pose significant threats to credit card processing. Cybercriminals constantly target sensitive cardholder data, and a successful breach can result in financial losses, reputational damage, and legal liabilities. To combat these risks, partner with reliable merchant service providers that prioritize data security, implement industry-standard encryption and tokenization technologies, and proactively monitor transaction data for suspicious activity. Regularly update your systems and train employees on security best practices to minimize the risk of data breaches.

Changing regulations and compliance

The regulatory landscape around merchant services and credit card processing can be complex and subject to frequent changes. Compliance with industry regulations, such as PCI DSS, is essential to protect cardholder data and maintain trust with your customers. Stay informed about new regulations and ensure your business remains compliant by regularly assessing your systems, policies, and procedures. Work closely with your merchant service provider to understand their compliance measures and ensure alignment with your business’s obligations.

Tips for Optimal Merchant Services & Credit Card Processing

Regularly reviewing and optimizing payment processes

Reviewing and optimizing your payment processes is crucial for staying ahead in today’s rapidly evolving business landscape. Regularly assess your payment systems, from the point-of-sale terminals to online payment gateways, to identify areas for improvement. Streamline your workflows, ensure seamless integration with other systems, and actively seek customer feedback to identify pain points and implement necessary changes.

Implementing additional security measures

While merchant service providers offer robust security measures, it is beneficial to implement additional security measures to further protect your business and customers. Consider utilizing fraud detection tools, implementing two-factor authentication, and regularly updating your systems and software with the latest security patches. Educate your employees about the importance of cybersecurity and implement strict access controls to minimize the risk of unauthorized access to sensitive data.

Staying updated with industry trends

Merchant services and credit card processing are dynamic fields that continually evolve alongside technological advancements and changing customer preferences. Stay updated with industry trends, emerging payment technologies, and shifts in customer behavior to ensure your business remains competitive. Subscribe to relevant industry publications, attend conferences or webinars, and join professional networks to stay informed and gain valuable insights from industry experts.

Educating employees about fraud prevention

Employee education is critical in preventing fraud and maintaining the security of your payment processes. Train your employees on recognizing potential signs of fraudulent activity, providing excellent customer service, and adhering to data security best practices. Establish clear protocols for handling suspicious transactions and reporting any concerns promptly. By fostering a culture of vigilance and awareness, you can significantly reduce the risk of fraud and protect your business and customers.

Establishing a strong relationship with the provider

Building a strong relationship with your merchant service provider can offer several advantages. Establish open lines of communication, promptly address any concerns or issues, and maintain regular contact with your account manager. A positive working relationship can lead to more favorable pricing, access to new features and technology, and dedicated support when you need it most. Regularly evaluate your provider’s performance and explore opportunities for collaboration and improvement.

In conclusion, understanding merchant services and credit card processing is crucial for businesses aiming to thrive in today’s digital and cashless economy. By comprehending the basics of credit card processing, considering the factors involved in choosing reliable merchant services, and prioritizing security and fraud prevention, businesses can leverage these services to improve customer satisfaction, streamline operations, and drive growth. Effective payment processing, supported by robust technologies and features, ensures a seamless and secure experience for both merchants and customers. By staying informed, mitigating challenges, and optimizing their payment processes, businesses can unlock the full potential of reliable merchant services and credit card processing.

Leave a Reply