Are you a business owner looking to grow your enterprise? Decoding the Confusion: Understanding ISV Payment Integrations for Business Growth is here to help! In this article, we will demystify the world of ISV payment integrations, providing you with valuable insights and knowledge to propel your business forward. Whether you’re in Detroit, Michigan or anywhere else, this article is your essential guide to maximizing growth through efficient payment systems. Stay tuned for the key to unlocking your business’s potential!

What is an ISV Payment Integration?

Definition of an ISV Payment Integration

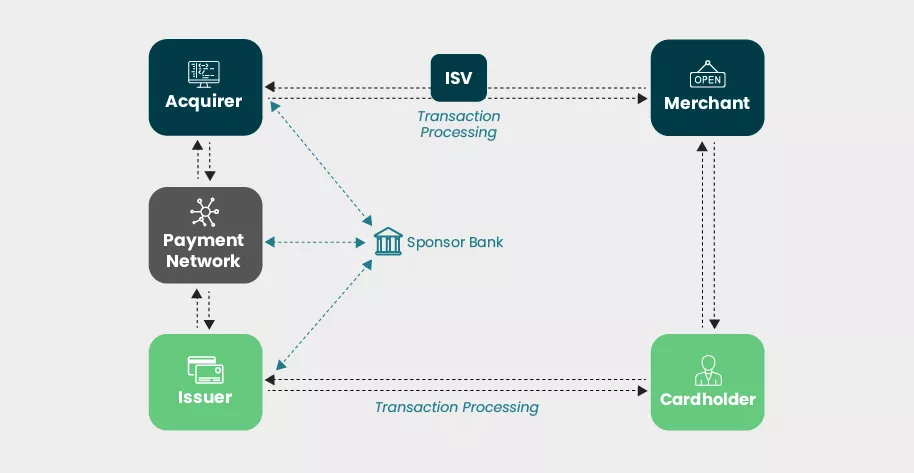

An ISV Payment Integration refers to the process of integrating a payment solution into an Independent Software Vendor’s (ISV) existing software or application. In simpler terms, it involves incorporating a payment gateway into the software, allowing customers to make payments through various channels, such as credit cards, mobile payments, or other electronic means.

Key Features of an ISV Payment Integration

ISV Payment Integrations come with a range of features that are tailored to meet the specific needs of businesses. Some key features include:

-

Payment Gateway Integration: This allows the software to connect with a payment processor or acquiring bank, enabling secure and seamless transactions.

-

Multiple Payment Options: ISV Payment Integrations offer flexibility by supporting multiple payment methods, including credit cards, debit cards, mobile payments, and digital wallets.

-

Recurring Billing: This feature allows businesses to set up automated recurring payments, such as subscriptions or monthly fees, ensuring a smooth and hassle-free payment process.

-

Customizable Payment Pages: ISV Payment Integrations provide the option to customize payment pages to align with the branding and design of the software, enhancing the overall customer experience.

-

Reporting and Analytics: These integrations often include robust reporting and analytics features, providing valuable insights into transaction data, customer behavior, and sales trends.

-

Security Features: ISV Payment Integrations prioritize data security by offering encryption, tokenization, and compliance with industry standards such as Payment Card Industry Data Security Standard (PCI DSS).

Benefits of ISV Payment Integrations

Increased Efficiency

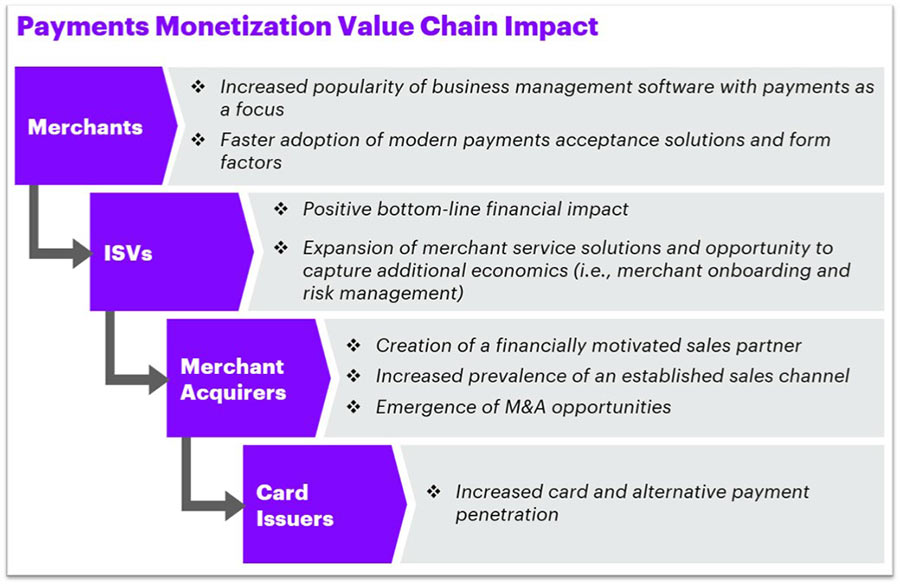

Implementing an ISV Payment Integration can significantly improve efficiency within a business. By automating payment processes and streamlining transactions, businesses can save time and resources that would have otherwise been spent on manual payment processing. This allows employees to focus on other essential tasks, ultimately boosting productivity.

Enhanced Customer Experience

ISV Payment Integrations play a crucial role in enhancing the customer experience by providing a seamless and convenient payment process. With a variety of payment options and secure transactions, customers can make payments effortlessly, leading to increased satisfaction and loyalty. Additionally, customizable payment pages create a cohesive brand experience, reinforcing the customer’s trust in the software and the business it represents.

Streamlined Operations

One of the key benefits of ISV Payment Integrations is the ability to streamline operations. With integrated payment solutions, businesses can consolidate their payment data into a centralized system, making it easier to manage and reconcile transactions. This eliminates the need for manual data entry and reduces the risk of error, resulting in more accurate financial reporting and improved efficiency.

Improved Security

Data security is a top concern for businesses, especially when it comes to handling sensitive financial information. ISV Payment Integrations prioritize security by implementing advanced encryption techniques, tokenization, and compliance with industry standards. By utilizing these security measures, businesses can minimize the risk of data breaches and protect their customers’ sensitive information, fostering trust and confidence in their software and services.

Choosing the Right ISV Payment Integration

Assessing Your Business Needs

Before choosing an ISV Payment Integration, it is essential to assess the specific needs of your business. Consider factors such as the volume and types of transactions your software handles, the target market, and any specific requirements or regulations that may apply to your industry.

Evaluating Integration Options

There are numerous ISV Payment Integration options available, each with its own set of features and capabilities. It is crucial to evaluate these options and choose one that aligns with your business goals and requirements. Look for integrations that offer the necessary payment methods, support for your target market, and integration with your existing software.

Consideration of Scalability

As your business grows, it is important to choose an ISV Payment Integration that can scale accordingly. Consider the potential increase in transaction volume and the ability of the integration to handle such growth effectively. Scalability ensures that your payment solution can accommodate your business’s evolving needs without causing disruptions or limitations.

Reviewing Security and Compliance Measures

Data security and compliance should be a top priority when choosing an ISV Payment Integration. Ensure that the integration provider adheres to industry standards such as PCI DSS and offers robust security measures like encryption and tokenization. Additionally, consider any specific regulatory requirements that may apply to your industry or geographical location.

Integration Process and Support

A smooth integration process and ongoing support are crucial for a successful ISV Payment Integration. Evaluate the integration provider’s implementation process, including integration timelines, technical support availability, and training resources. Make sure the provider offers reliable support channels and has a track record of assisting customers throughout the integration process and beyond.

Cost Analysis

Consider the cost implications of implementing an ISV Payment Integration. Evaluate the pricing structure, transaction fees, and any additional costs associated with the integration. Compare the total cost of ownership with the benefits and value the integration brings to your business. Remember to factor in potential growth and scalability to ensure the integration remains cost-effective in the long run.

Common Challenges with ISV Payment Integrations

Lack of Integration Expertise

Implementing an ISV Payment Integration requires technical expertise and knowledge. Many businesses may lack the in-house skills or resources to handle the integration process effectively. This can lead to delays, errors, or even unsuccessful integrations. To overcome this challenge, consider partnering with an integration specialist or seeking support from the integration provider.

Incompatibility Issues

Compatibility issues between the ISV Payment Integration and existing software can pose a significant challenge. Incompatibility may arise due to differences in programming languages, database systems, or protocols. Thoroughly assess the integration requirements and ensure compatibility between the integration and your software to avoid any disruptions or limitations.

Inadequate Support and Maintenance

After the initial integration, ongoing support and maintenance are essential for the smooth operation of the ISV Payment Integration. Businesses may face challenges if the integration provider does not offer reliable support or fails to address any issues promptly. It is crucial to choose a provider that offers comprehensive support and maintenance services to mitigate any potential problems.

System Downtime and Reliability

System downtime can have severe implications for businesses relying on ISV Payment Integrations. Even a short period of downtime can result in missed transactions, revenue loss, and damage to reputation. It is important to choose an integration provider known for the reliability and stability of their systems to minimize the risk of downtime and ensure uninterrupted payment processing.

Data Security Risks

Data security is an ongoing concern for businesses, and ISV Payment Integrations introduce an additional layer of risk. Inadequate security measures can make businesses vulnerable to data breaches and compromise customer information. It is crucial to choose an integration provider that prioritizes data security and complies with industry standards and regulations to mitigate these risks effectively.

Best Practices for Successful ISV Payment Integrations

Thorough Planning and Analysis

Before embarking on an ISV Payment Integration, invest time in thorough planning and analysis. Understand your business requirements, identify goals, and define success criteria. This will ensure the integration meets your objectives and minimizes the risk of unexpected challenges.

Collaboration with Integration Partners

Effective collaboration with integration partners is crucial for a successful integration. Engage in open communication and establish a strong working relationship with the integration provider. Regular communication, sharing of information, and alignment of expectations will contribute to a smoother integration process.

Regular System Monitoring and Testing

To maintain optimal performance, regularly monitor and test your ISV Payment Integration. Create a monitoring plan to identify any issues or anomalies early on. Conduct regular tests to ensure all payment methods function correctly and data is securely transmitted. This proactive approach will help address any potential issues before they impact operations.

Continuous Training and Education

Keep your team informed and up-to-date on the ISV Payment Integration. Provide comprehensive training to employees responsible for payment processing or customer support. Educate them on the features and functionalities of the integration, as well as any updates or enhancements. Continuous training will help maximize the benefits of the integration and ensure optimal utilization.

Effective Communication with Customers

Transparent and timely communication with customers is essential throughout the integration process. Keep your customers informed about any changes or disruptions that may occur during the integration. Provide them with clear instructions and support channels to address any concerns or issues they may encounter. Effective communication will help maintain customer trust and minimize any negative impact on their experience.

Avoiding Scope Creep

Scope creep refers to the tendency for projects to grow beyond their initial scope. To avoid scope creep in an ISV Payment Integration, clearly define the scope and deliverables from the outset. Stick to the agreed-upon requirements and actively manage any changes or additions. This will help maintain focus and prevent the project from becoming overly complex or unmanageable.

Trends in ISV Payment Integrations

Real-time Analytics and Reporting

The demand for real-time analytics and reporting in ISV Payment Integrations is on the rise. Businesses are looking for insights into transaction data, customer behavior, and sales trends in real-time to make data-driven decisions. Integrations that offer advanced reporting and analytics capabilities provide businesses with a competitive advantage in understanding and optimizing their payment processes.

Mobile Payment Integrations

With the increasing use of smartphones and mobile devices, mobile payment integrations are becoming more prevalent. Businesses are recognizing the importance of providing a seamless mobile payment experience to their customers. Integrations that support mobile payment methods, such as digital wallets or mobile apps, enable businesses to cater to the growing segment of customers who prefer making payments through their mobile devices.

Omnichannel Payment Solutions

Customers expect a consistent payment experience across various channels, whether it be online, in-store, or mobile. Omnichannel payment solutions are gaining popularity in ISV Payment Integrations as they allow businesses to facilitate payments seamlessly across multiple touchpoints. This integration ensures a unified experience for customers, regardless of the channel they choose to make their payments.

Artificial Intelligence and Machine Learning Integration

The integration of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing ISV Payment Integrations. By leveraging AI and ML algorithms, integrations can enhance fraud detection, mitigate risk, and personalize customer experiences. These technologies enable the software to learn and adapt based on transaction patterns, providing businesses with more accurate and efficient payment processing.

Voice-activated Payment Processing

Voice-activated payment processing is an emerging trend in ISV Payment Integrations. As voice assistants like Amazon Alexa and Google Assistant become increasingly popular, businesses are exploring ways to leverage voice-activated payments. Integrations that allow customers to make payments using voice commands offer convenience and a hands-free experience, especially in situations where customers have limited access to their mobile devices.

Case Studies of Successful ISV Payment Integrations

Company A: Streamlining Operations with ISV Payment Integration

Company A, a fast-growing e-commerce software provider, implemented an ISV Payment Integration to streamline their payment processes. By integrating a payment gateway into their software, they were able to automate payment processing and reconciliation. This resulted in significant time savings for their employees, who were able to focus on more value-added tasks. Furthermore, the integration provided a seamless payment experience for their customers, leading to increased customer satisfaction and loyalty.

Company B: Achieving Seamless Customer Experience through ISV Payment Integration

Company B, a retail software vendor, recognized the importance of delivering a seamless customer experience across online and in-store channels. They chose an ISV Payment Integration that supported omnichannel payments, enabling customers to make payments through various touchpoints. This integration allowed for a unified payment experience, regardless of whether the customer chose to shop online or in-store. As a result, Company B saw an increase in conversion rates and customer satisfaction levels.

Company C: Enhancing Security with ISV Payment Integration

Company C, a software provider operating in the healthcare industry, prioritized data security in their ISV Payment Integration. They chose an integration provider that implemented robust encryption and tokenization techniques to protect sensitive patient payment information. This added layer of security ensured compliance with industry regulations and gave their customers peace of mind. By enhancing data security, Company C was able to build trust with their clients and differentiate themselves in a highly regulated industry.

Future of ISV Payment Integrations

Expansion of Integration Capabilities

The future of ISV Payment Integrations will likely involve the expansion of integration capabilities. Integrations will evolve to support a wider range of payment methods, including emerging technologies such as cryptocurrency. Additionally, integrations may offer more advanced features like real-time fraud detection and prevention, further enhancing security and efficiency.

Growth in Customization and Personalization

As businesses strive to differentiate themselves in a competitive market, customization and personalization will play a significant role in ISV Payment Integrations. Integrations will offer more options for businesses to customize their payment pages, branding, and user experiences. This will allow businesses to create a unique and tailored payment experience for their customers, boosting brand loyalty and customer satisfaction.

Increased Adoption of Cloud-based Solutions

The adoption of cloud-based solutions in ISV Payment Integrations is expected to increase in the future. Cloud-based integrations offer flexibility, scalability, and ease of deployment. Businesses can access their payment data from anywhere, anytime, and benefit from automatic updates and enhanced security measures. Cloud-based integrations also promote collaboration and integration with other cloud-based applications, further streamlining business operations.

Integration of Emerging Technologies

Emerging technologies such as blockchain and Internet of Things (IoT) will likely play a significant role in the future of ISV Payment Integrations. Blockchain technology can enhance security and transparency in payment processes, while IoT devices can enable seamless and secure payments in various contexts. Integrations that leverage these technologies will provide businesses with new opportunities for innovation and optimization.

Integration with Internet of Things (IoT)

The Internet of Things (IoT) holds immense potential for ISV Payment Integrations. By integrating payment capabilities into IoT devices, businesses can offer a seamless and frictionless payment experience in connected environments. For example, smart vending machines or connected cars can accept payments directly, eliminating the need for traditional payment methods. This integration opens up new avenues for businesses to monetize IoT devices and provide convenience to their customers.

Conclusion

ISV Payment Integrations offer numerous benefits for businesses, including increased efficiency, enhanced customer experience, streamlined operations, and improved security. By choosing the right integration, businesses can overcome common challenges and leverage best practices to achieve successful integration. The future of ISV Payment Integrations looks promising, with trends such as real-time analytics, mobile payment integrations, and the integration of emerging technologies shaping the landscape. As businesses continue to recognize the value of ISV Payment Integrations, the integration capabilities will expand, customization will increase, and the adoption of cloud-based solutions and emerging technologies will pave the way for innovative payment experiences.

Leave a Reply