Imagine running a subscription-based business without the headaches of managing recurring billing. In this article, you’ll discover a variety of tools that can streamline your payment process, making it easier than ever to collect payments from your customers. From automated invoicing to customizable payment plans, these tools will simplify your recurring billing and help you focus on what really matters – growing your business. Say goodbye to time-consuming manual billing and hello to a more efficient way of managing payments.

Understanding Recurring Billing

Definition of recurring billing

Recurring billing refers to the automated process of collecting payments from customers on a regular basis, typically through subscription-based models. It allows businesses to charge their customers at predefined intervals for products or services they have subscribed to. This payment method is widely used in various industries such as software-as-a-service (SaaS), streaming platforms, membership websites, and many more.

Importance of recurring billing for subscription-based businesses

Recurring billing plays a crucial role in the success of subscription-based businesses. It provides a stable and predictable revenue stream, allowing businesses to forecast their cash flow accurately. It simplifies the payment process for both businesses and customers, reducing the hassle of manual invoicing and payment collection. Furthermore, recurring billing enhances customer experience by ensuring uninterrupted access to products or services and offering convenient payment options. By automating the billing process, businesses can focus on providing value to their subscribers and growing their customer base.

Benefits of Streamlining Payments

Efficiency and time-saving

Implementing a streamlined recurring billing system saves businesses valuable time and resources. Without the need for manual invoice generation and payment collection, companies can allocate their staff to more productive tasks, such as customer support or product development. The automation of the payment process ensures timely payments and eliminates the risk of human error. With streamlined payments, businesses can operate more efficiently and focus on delivering exceptional products or services to their subscribers.

Improved cash flow management

For subscription-based businesses, cash flow management is essential for survival and growth. Recurring billing ensures a steady stream of income, as payments are automatically processed at regular intervals. This stability allows businesses to accurately project their revenue and plan for future investments or expansion. By streamlining payments, companies can achieve better cash flow management, enabling them to make informed financial decisions and meet their operational needs on time.

Enhanced customer experience and satisfaction

Seamless payment experiences are essential for maintaining customer satisfaction and loyalty. By streamlining payments through recurring billing, businesses can offer convenient payment options, such as credit cards or online payment platforms, to their subscribers. These payment methods are familiar and trusted, which increases customer confidence. Recurring billing also guarantees uninterrupted access to products or services, ensuring a seamless customer experience. By providing hassle-free payment processes, businesses can enhance customer satisfaction and build long-term relationships.

Choosing the Right Payment Gateway

Factors to consider when selecting a payment gateway

Selecting the right payment gateway is crucial for successful recurring billing. Consider the following factors when choosing a payment gateway:

- Integration: Ensure that the payment gateway can easily integrate with your existing systems, such as your website or customer management software.

- Security: Prioritize the security features offered by the payment gateway, such as data encryption and tokenization, to protect your customers’ sensitive information.

- Pricing structure: Compare the pricing plans and transaction fees of different payment gateway providers to find the most cost-effective option for your business.

- Payment methods: Check if the payment gateway supports a wide range of payment methods to cater to your customers’ preferences.

- Customer support: Evaluate the level of customer support provided by the payment gateway provider, as it will be crucial in case of any issues or technical difficulties.

Popular payment gateways for recurring billing

Some popular payment gateway options for recurring billing include:

- Stripe: Known for its developer-friendly platform, Stripe offers robust recurring billing features, easy integration options, and competitive fees.

- PayPal: Widely recognized and trusted, PayPal provides recurring billing options for businesses of all sizes, with multiple payment method options and excellent customer support.

- Braintree: Owned by PayPal, Braintree is another reliable payment gateway solution that specializes in recurring billing. It offers seamless integration, advanced security features, and transparent pricing structures.

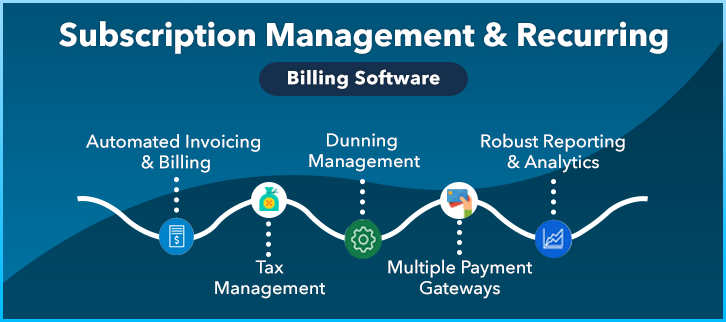

Key features to look for in a payment gateway

When evaluating payment gateway options, consider the following key features:

- Recurring billing functionality: Ensure that the payment gateway supports automated recurring billing processes, allowing you to set up subscription cycles and manage customer payments easily.

- API integration: Look for a payment gateway with well-documented APIs that make integration with your existing systems seamless and efficient.

- Customization options: Check if the payment gateway allows you to customize payment pages or emails, enabling you to maintain brand consistency throughout the payment process.

- Reporting and analytics: Opt for a payment gateway that provides detailed reporting and analytics, giving you insights into payment trends, subscription metrics, and customer behavior.

- Developer-friendly environment: If you have in-house development resources, choose a payment gateway that offers comprehensive documentation, sample code, and libraries to facilitate integration and customization.

Automating Billing Cycles

Setting up automated billing cycles

Automating billing cycles is a fundamental aspect of recurring billing. To set up automated billing cycles, businesses must follow these steps:

- Define billing intervals: Determine the frequency at which you will bill your customers, such as monthly, quarterly, or annually.

- Establish pricing tiers: If your business offers different subscription plans or pricing tiers, decide on the specific rates for each level.

- Choose payment methods: Select the payment methods you will accept, such as credit cards, debit cards, or online payment platforms.

- Set up customer profiles: Create customer profiles within your payment gateway or subscription management system, capturing their billing and payment information.

- Configure automated billing rules: Configure your payment gateway or subscription management system to automatically collect payments from customers based on their billing schedules.

- Test and monitor: Before going live, test the automated billing system thoroughly to ensure everything is functioning correctly. Monitor the process regularly to identify any issues or payment failures.

Recurring billing options and schedules

Recurring billing offers different options for businesses to charge their customers:

- Fixed billing dates: Charge customer accounts on specific, pre-determined dates each billing cycle. For example, billing all customers on the 1st of every month.

- Variable billing dates: Instead of fixed dates, charge customers based on the day they initially subscribed. For example, if a customer signed up on the 15th of the month, they would be billed on the 15th of every subsequent month.

- Anniversary billing: Charge customers on the anniversary of their subscription start date. This option allows for flexibility, as each customer’s billing cycle aligns with their individual subscription start date.

Businesses should consider their customers’ preferences and the nature of their products or services when choosing the most suitable recurring billing option.

Integration with accounting software

Integrating your recurring billing system with accounting software offers numerous benefits, such as streamlined financial management and improved accuracy. When selecting accounting software for integration, consider the following:

- Compatibility: Ensure that the accounting software you choose can integrate seamlessly with your existing payment gateway or subscription management system.

- Data synchronization: Look for software that automatically syncs billing and payment data, reducing the need for manual data entry and minimizing the risk of errors.

- Financial reporting capabilities: Select accounting software that provides robust reporting features to help you track revenue, cash flow, and financial health effectively.

- Automated bookkeeping: Utilize software that automatically creates invoices and records payments, saving time and effort in manual bookkeeping tasks.

- Scalability: Consider the scalability of the accounting software, as your business grows and your billing volumes increase.

By integrating your billing system with accounting software, you can streamline financial processes, improve accuracy, and gain real-time visibility into your business’s financial performance.

Managing Customer Subscriptions

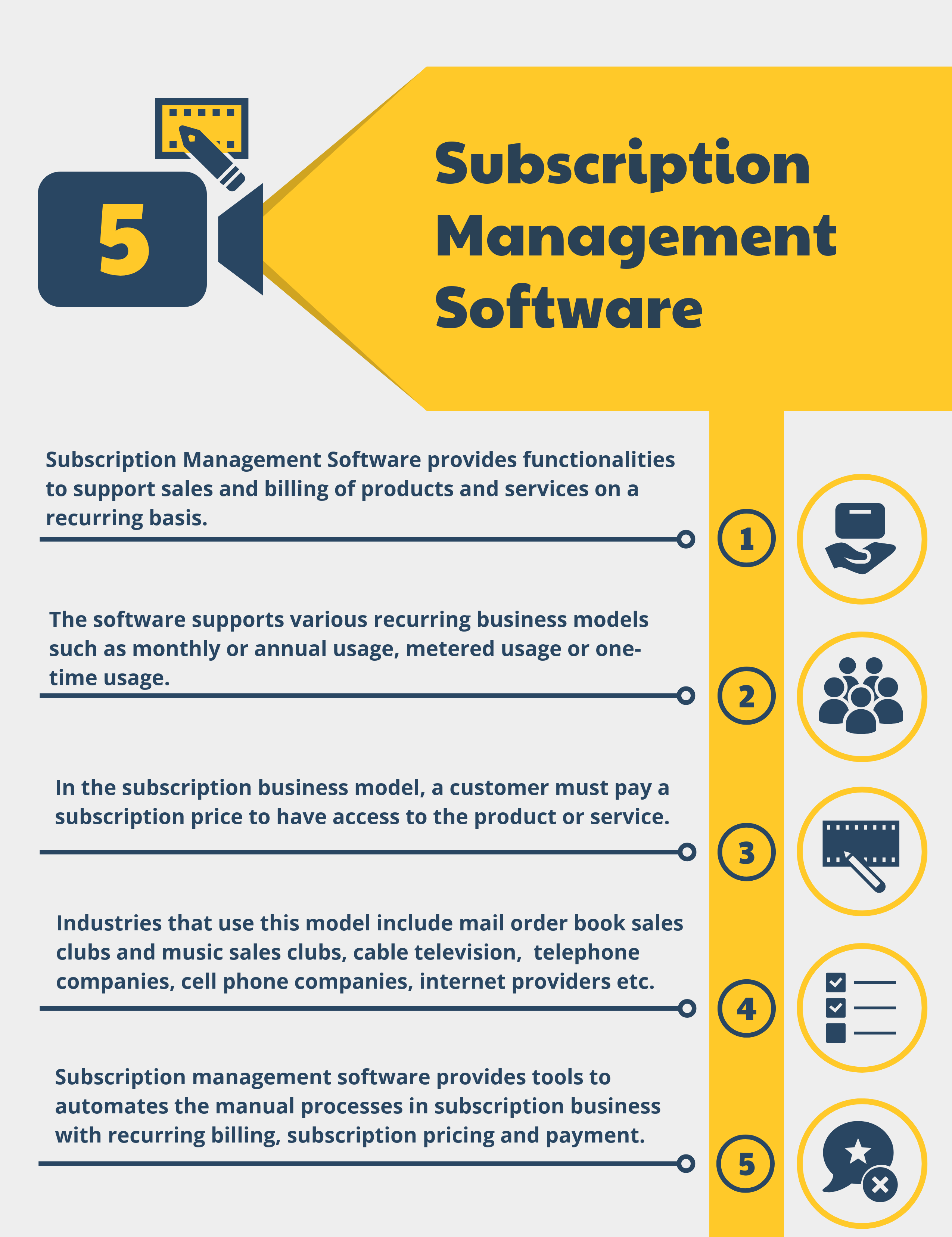

Subscription management platforms

Subscription management platforms are powerful tools that enable businesses to effectively manage their customer subscriptions. These platforms provide comprehensive features and functionalities to handle the entire subscription lifecycle. Key benefits offered by subscription management platforms include:

- Subscription creation and customization: Easily create and customize subscription plans, pricing tiers, and billing cycles according to your business needs.

- Customer self-service portals: Empower customers to manage their subscriptions, update payment information, and access billing history through user-friendly self-service portals.

- Billing automation: Automate the billing process, including payment collection, invoicing, and dunning processes, to ensure seamless subscription management and revenue collection.

- Analytics and reporting: Gain valuable insights into subscription metrics, revenue trends, and customer churn rates through in-depth analytics and reporting tools.

- Integration capabilities: Integrate with various third-party systems, such as payment gateways, accounting software, and customer relationship management (CRM) platforms, to streamline data flow and improve operational efficiency.

Key features of subscription management tools

When selecting a subscription management platform, consider the following key features:

- Subscription creation and management: Look for a platform that allows you to easily create and manage different subscription plans, pricing options, and billing cycles.

- Flexible payment options: Ensure the platform supports a variety of payment methods, including credit cards, debit cards, and alternative payment solutions, to accommodate customer preferences.

- Dunning and retries: Choose a platform that automates the dunning process for failed payments and offers multiple retry attempts to maximize successful payment collection.

- Customer self-service portals: Opt for a platform that provides self-service portals where customers can update their payment information, view billing history, and manage their subscriptions.

- Analytics and reporting: Select a platform that offers robust analytics and reporting tools to monitor subscription metrics, customer behavior, and revenue trends.

- Integration capabilities: Evaluate the platform’s integration capabilities with other systems such as CRM software, payment gateways, and accounting software, to ensure smooth data flow and operational efficiency.

By utilizing subscription management tools, businesses can streamline their subscription processes, improve customer experience, and achieve efficient revenue management.

Handling cancellations and upgrades/downgrades

Managing customer cancellations, upgrades, and downgrades is crucial for subscription-based businesses. Effective processes need to be in place to handle these scenarios seamlessly. Here are some essential considerations for handling cancellations and upgrades/downgrades:

- Cancellation policies: Define clear and transparent cancellation policies, including notice periods and refund policies, to manage customer expectations and avoid disputes.

- Subscription retention offers: Implement strategies to retain customers who want to cancel their subscriptions, such as offering discounted rates, additional features, or pause options.

- Upgrade/downgrade options: Provide customers with flexible options to upgrade or downgrade their subscriptions based on their changing needs or budgets.

- Automated processes: Utilize subscription management tools that automate cancellation, upgrade, and downgrade processes, ensuring accuracy and efficiency.

- Communication and follow-up: Maintain open lines of communication with customers, promptly responding to cancellation or change requests, and seeking feedback to improve your services.

Properly managing cancellations, upgrades, and downgrades is essential for maintaining customer satisfaction, reducing churn, and maximizing customer lifetime value.

Handling Failed Payments

Common reasons for payment failures

Failed payments can occur for various reasons. Some common reasons include:

- Insufficient funds: When customers’ bank accounts or credit cards do not have enough funds to cover the payment.

- Expired payment methods: When customers’ credit cards or other payment methods have expired and have not been updated.

- Declined transactions: When a transaction is declined by the customer’s bank due to suspected fraud, insufficient credit limit, or other security reasons.

- Payment processor issues: Technical issues or downtime with the payment gateway or payment processor can result in failed payments.

- Customer error: Errors made by customers during the payment process, such as entering incorrect payment details or not completing the payment steps correctly.

Automated retry and payment recovery

To minimize revenue loss from failed payments, businesses can implement automatic retry mechanisms and payment recovery processes. These include:

- Smart retry logic: Utilize intelligent algorithms that determine the optimal time and frequency for payment retries, increasing the chances of successful collection.

- Grace periods: Implement grace periods to allow customers a short timeframe to resolve payment issues. During this period, no interruption in service occurs.

- Automated email notifications: Send automated email notifications to customers with failed payments, providing clear instructions for resolving payment issues and updating their payment information.

- Multiple payment methods: Offer alternative payment methods to customers with failed payments, allowing them to update their payment details or switch to another payment option.

- Retry schedule customization: Allow customers to customize their payment retry schedule or opt for manual payment, providing them with more control over the billing process.

- Declined payment management: Implement processes to proactively manage declined payments, such as contacting the customer for updated payment information or initiating manual payment retries.

Employing automated retry mechanisms and payment recovery processes helps businesses minimize revenue loss, improve customer retention, and provide an overall positive payment experience.

Managing declined payments and dunning processes

Handling declined payments and implementing effective dunning processes are crucial for subscription-based businesses to recover outstanding payments and maintain healthy cash flow. Here are some best practices:

- Dunning emails: Send automated dunning emails to customers with declined payments, informing them about the issue, providing payment instructions, and requesting them to update their payment information.

- Dunning escalation: Set up dunning escalation processes, where subsequent emails are sent with increased urgency and frequency as the payment issue persists.

- Personalized communication: Tailor dunning emails to address individual customers, using their names and referencing relevant subscription details to improve the chances of successful payment recovery.

- Alternative payment methods: Offer alternative payment methods or give customers the option to update their payment information easily within the dunning emails.

- Intelligent dunning systems: Utilize dunning management software that automatically triggers dunning emails, keeps track of customer responses, and escalates the process as necessary.

- Manual follow-up: For high-value customers or complex payment issues, consider providing personalized customer support, such as phone calls or live chat, to manually resolve the payment problem.

By effectively managing declined payments and implementing proactive dunning processes, businesses can increase payment recovery rates and maintain a healthy financial position.

Securing Payment Data

Importance of data security in recurring billing

With the increasing prevalence of cyber threats and data breaches, ensuring the security of payment data is of paramount importance for subscription-based businesses. Data security is crucial for protecting sensitive customer information, maintaining customer trust, and complying with legal and industry regulations. By implementing robust data security measures, businesses can safeguard payment data and mitigate the risk of financial loss and reputational damage.

PCI DSS compliance for subscription-based businesses

Subscription-based businesses are often required to comply with the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS outlines a set of security standards and requirements that businesses who handle credit card information must adhere to. Key steps for achieving PCI DSS compliance include:

- Build and maintain a secure network: Implement secure network configurations, such as firewalls, to protect cardholder data from unauthorized access.

- Protect cardholder data: Encrypt stored cardholder data, use strong access control measures, and restrict access to sensitive information on a need-to-know basis.

- Maintain a vulnerability management program: Regularly update security systems and software, apply patches promptly, and conduct regular security audits and vulnerability assessments.

- Implement strong access control measures: Assign a unique ID to each person with computer access, restrict physical and logical access to cardholder data, and regularly monitor access logs.

- Regularly monitor and test networks: Continuously monitor all access to cardholder data, regularly test security systems and processes, and maintain an information security policy.

- Maintain an information security policy: Develop and document a comprehensive information security policy that addresses all relevant PCI DSS requirements and educate employees about their roles and responsibilities.

By achieving and maintaining PCI DSS compliance, subscription-based businesses can ensure the protection of payment data, minimize the risk of data breaches, and demonstrate their commitment to data security.

Implementing encryption and tokenization

Encryption and tokenization are two essential methods for enhancing the security of payment data:

- Encryption: Encryption is the process of converting sensitive payment data into unreadable code, which can only be decrypted with a unique encryption key. Implementing strong encryption methods ensures that even if data is intercepted or accessed maliciously, it remains unusable.

- Tokenization: Tokenization replaces sensitive payment data, such as credit card numbers, with randomly generated tokens. The actual data is securely stored in a separate system, and tokens are used for transaction processing, reducing the risk of unauthorized access to sensitive information.

By implementing encryption and tokenization techniques, businesses can strengthen the security of payment data, protect customer information, and minimize the impact of data breaches.

Integrating with Other Systems

CRM and customer data integration

Integrating recurring billing systems with customer relationship management (CRM) software offers numerous benefits, including:

- Seamless data flow: Integrating CRM with recurring billing systems eliminates the need for manual data entry, ensuring accuracy and consistency between customer and billing information.

- Enhanced customer profiles: The integration allows businesses to access comprehensive customer profiles in CRM systems, including subscription details, billing history, and payment preferences.

- Targeted marketing campaigns: With integrated data, businesses can segment customers based on their subscription plans and payment behaviors, allowing for personalized marketing campaigns and cross-selling opportunities.

- Streamlined customer support: With access to up-to-date subscription and payment information, customer support teams can provide better assistance to customers and resolve billing-related issues more efficiently.

By integrating recurring billing systems with CRM software, businesses can improve operational efficiency, enhance customer experience, and streamline communication between departments.

Email marketing and communication integration

Integrating recurring billing systems with email marketing platforms and communication tools enables businesses to:

- Automate customer communication: Automated emails can be triggered and sent based on specific billing events, such as successful payments, failed payments, or upcoming subscription renewals.

- Personalize communication: With integrated customer data, businesses can customize email content based on each customer’s subscription details, payment history, and other relevant information.

- Retention campaigns: Email platforms can help businesses create targeted retention campaigns to engage customers, reduce churn, and offer special promotions or discounts to encourage continued subscription.

- Billing notifications: Provide customers with timely and informative billing notifications, such as upcoming payment reminders, payment receipts, or failed payment alerts, to keep them informed about their subscription status.

Integrating recurring billing systems with email marketing and communication tools enables businesses to deliver personalized, timely, and relevant communication to customers, increasing engagement and customer satisfaction.

E-commerce platforms and inventory management

Integrating recurring billing systems with e-commerce platforms and inventory management systems offers several advantages, including:

- Seamless order processing: Automatically create and process orders in the e-commerce platform based on customer subscriptions and billing cycles, eliminating the need for manual order entry.

- Real-time inventory sync: Ensure accurate inventory management by synchronizing product availability and stock levels between the e-commerce platform and inventory management system.

- Upselling and cross-selling opportunities: Utilize integrated data to identify upselling or cross-selling opportunities based on customers’ subscription plans or purchasing history.

- Order fulfillment automation: Automate the fulfillment process by connecting recurring billing systems with your inventory management system, minimizing manual intervention and improving operational efficiency.

- Revenue recognition and financial reporting: Integrate with accounting software to facilitate accurate revenue recognition, financial reporting, and reconciliation between the e-commerce platform and recurring billing systems.

By integrating recurring billing systems with e-commerce platforms and inventory management systems, businesses can streamline order processing, improve inventory management, and optimize revenue recognition.

Analyzing Subscription Metrics

Key performance indicators (KPIs) for subscription businesses

Analyzing key performance indicators (KPIs) is crucial for measuring the success and health of subscription-based businesses. Some essential KPIs to consider include:

- Monthly recurring revenue (MRR): MRR represents the predictable, recurring revenue generated from subscriber fees on a monthly basis. Tracking MRR provides insight into revenue growth or decline.

- Customer lifetime value (CLTV): CLTV measures the total revenue expected from a customer throughout their entire relationship with the business. Understanding CLTV helps assess the viability and profitability of customer acquisition strategies.

- Churn rate: Churn rate represents the percentage of customers who unsubscribe or cancel their subscriptions within a specific period. A high churn rate indicates potential issues with customer retention or product satisfaction.

- Customer acquisition cost (CAC): CAC quantifies the investment required to acquire a new customer. Analyzing CAC helps businesses assess the effectiveness and efficiency of their marketing and sales efforts.

- Customer engagement and usage metrics: Metrics such as user logins, feature usage, and session duration provide insights into customer engagement, satisfaction, and the value they derive from the product or service.

By monitoring these KPIs, businesses can assess their performance, identify areas for improvement, and make data-driven decisions to drive growth and profitability.

Analyzing churn rate and customer retention

Churn rate, representing the percentage of customers who cancel their subscriptions, is a critical metric to analyze for subscription-based businesses. To effectively analyze churn rate and improve customer retention, consider the following approaches:

- Identify churn drivers: Analyze customer data to identify common patterns or factors leading to churn. This can include demographics, subscription features or pricing, customer support issues, or lacking perceived value.

- Implement churn prediction models: Utilize advanced analytics and machine learning algorithms to build churn prediction models, which can identify customers at risk of churning based on their behavior, usage patterns, or demographic information.

- Churn mitigation strategies: Develop and implement strategies to reduce churn rates, such as proactively reaching out to at-risk customers, offering personalized retention offers, or improving customer support processes.

- Customer feedback and satisfaction surveys: Regularly collect feedback from customers, whether through surveys, feedback forms, or customer support interactions. This feedback can provide insights into areas for improvement and help address gaps in product or service satisfaction.

- Customer onboarding and education: Focus on providing a seamless onboarding experience for new customers, ensuring they understand the value of the product or service and receive proper education on its usage.

- Continuous product improvement: Regularly analyze customer feedback and usage metrics to identify areas for product improvement or new feature development, increasing customer satisfaction and reducing churn.

By analyzing churn rate and implementing effective retention strategies, businesses can reduce customer turnover, increase customer lifetime value, and achieve sustainable growth.

Forecasting and revenue projections

Accurate revenue forecasting is essential for financial planning, budgeting, and sustainable growth. When projecting revenue for subscription-based businesses, consider these key factors:

- Subscription growth rates: Analyze historical subscription growth rates to forecast future growth patterns. Consider factors such as customer acquisition, churn rates, and upgrades or downgrades in subscription plans.

- Pricing changes and plan mix: Assess the impact of changes in pricing or introduction of new subscription plans on revenue projections. Evaluate the potential shifts in the mix of customers subscribing to different plans.

- Upselling and cross-selling opportunities: Take into account the potential impact of upselling or cross-selling initiatives on revenue projections. Identify which subscription plans or additional features offer the most opportunities for expansion.

- Seasonality and customer behavior: Consider seasonal trends, such as increased usage or demand during specific periods. Analyze historical customer behavior and subscription data to uncover patterns and anticipate revenue fluctuations.

- Market trends and competition: Stay abreast of market trends, competitor moves, and industry dynamics that may impact your revenue projections. Conduct competitive analysis to understand how your business compares to others in the market.

By incorporating these factors into revenue projections, businesses can make informed decisions, develop effective strategies, and allocate resources more efficiently to ensure long-term financial stability and growth.

Customer Support and Self-Service

Providing responsive customer support

Delivering responsive and effective customer support is crucial for maintaining customer satisfaction and loyalty. Consider implementing the following practices:

- Multi-channel support: Offer customer support through multiple channels, such as email, phone, live chat, and social media, to provide customers with various options to reach out for assistance.

- Prompt response times: Strive to respond to customer queries and support requests in a timely manner, setting realistic expectations for response times and actively managing customer expectations.

- Knowledgeable and empathetic support agents: Ensure your support team is well-trained, knowledgeable about your products or services, and capable of providing empathetic and personalized assistance to customers.

- Ticketing systems: Utilize ticketing systems to manage customer support inquiries effectively, tracking issues from submission to resolution and ensuring no customer request falls through the cracks.

- Regular follow-ups: After resolving customer support inquiries or issues, follow up to ensure customer satisfaction and address any additional concerns or questions.

By providing responsive customer support, businesses can strengthen customer relationships, enhance customer satisfaction, and increase customer loyalty and advocacy.

Self-service options for customers

Empowering customers with self-service options allows them to access information and resolve issues independently, improving their overall experience. Implement the following self-service options:

- Knowledge base and FAQs: Create a comprehensive knowledge base or FAQ section on your website or customer portal, addressing common issues, frequently asked questions, and step-by-step guides.

- Chatbots and AI-powered assistants: Utilize chatbots or AI-powered assistants to provide instant responses and automated assistance to customers, guiding them through troubleshooting steps or frequently asked questions.

- Video tutorials and webinars: Produce video tutorials or webinars to provide customers with visual instructions and guidance on product usage, best practices, and advanced features.

- Community forums and user communities: Establish online forums or user communities where customers can interact with each other, ask questions, share insights, and receive support from fellow users.

- Self-service portals: Implement self-service portals where customers can manage their subscriptions, update payment information, view billing history, and make account changes independently.

By offering self-service options, businesses can empower customers, reduce support costs, and provide added convenience, ultimately improving customer satisfaction and loyalty.

Implementing live chat and knowledge base

Implementing live chat and maintaining a comprehensive knowledge base are effective strategies for delivering exceptional customer support. Consider the following practices:

- Live chat: Embed live chat functionality on your website and customer portal, allowing customers to initiate real-time conversations with support agents. Ensure prompt response times and effective issue resolution through live chat interactions.

- Knowledge base organization: Maintain an organized and user-friendly knowledge base that is easy to navigate, divided into relevant categories or sections to help customers quickly find the information they need.

- Regular knowledge base updates: Continuously update and expand your knowledge base to include new features, product updates, and answers to frequently asked questions. This ensures that it remains a valuable and up-to-date resource for customers.

- Interactive self-help tools: Incorporate interactive self-help tools within the knowledge base, such as interactive troubleshooting guides or step-by-step walkthroughs, to assist customers in resolving issues independently.

- Collecting customer feedback: Regularly solicit customer feedback on the knowledge base’s usefulness and usability, allowing customers to provide suggestions for improvement and identify any gaps in information.

By implementing live chat functionality and maintaining a comprehensive knowledge base, businesses can provide immediate support, access a centralized source of information, and enhance the overall customer support experience.

Leave a Reply