In this article, we will be exploring the various payment options available for businesses. Whether you are a small startup or a well-established company, the way you accept payments can greatly impact your success. From traditional methods like cash and checks to modern solutions such as credit cards and mobile payments, we will delve into the pros and cons of each option, helping you make an informed decision for your business. So let’s get started and discover the different types of payment acceptance that can help propel your business forward!

Traditional Payment Options

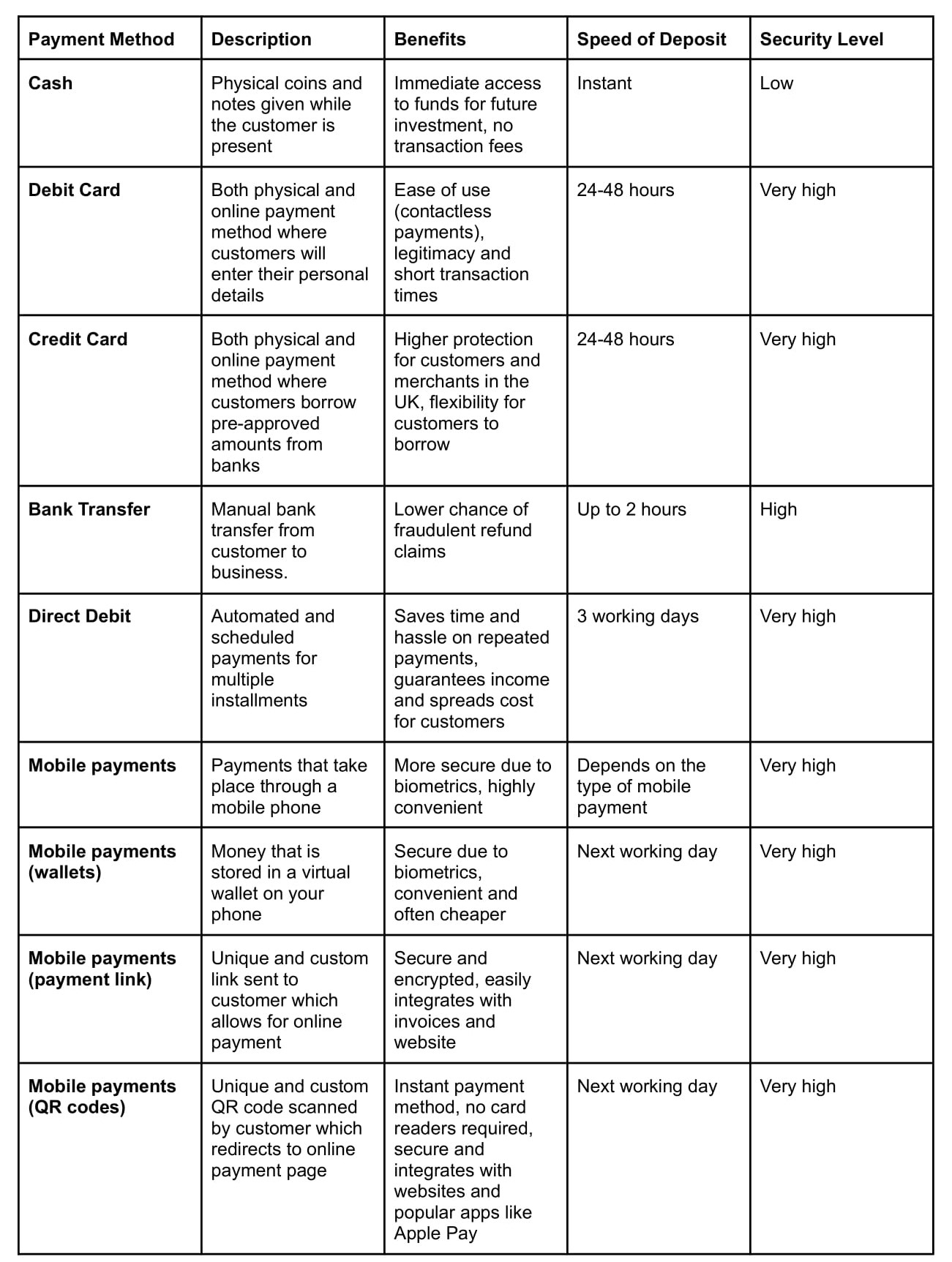

Traditional payment options refer to the methods of payment that have been used for many years. These options include cash, checks, and credit/debit cards.

Cash

Cash is the oldest and most widely accepted form of payment. It is a tangible currency that can be easily exchanged for goods and services. Accepting cash as payment allows businesses to have immediate access to funds. However, handling cash can be inconvenient and time-consuming, as it requires counting, sorting, and ensuring the accuracy of the transactions.

Checks

Checks have been a popular form of payment for many years. They offer a convenient way for customers to make payments without carrying large amounts of cash. Businesses can accept checks and deposit them into their bank accounts. However, accepting checks comes with the risk of receiving bounced checks or fraudulent payments.

Credit/Debit Cards

Credit and debit cards have become the preferred method of payment for many customers. These cards allow customers to make electronic payments by swiping or inserting their cards into card readers. Businesses can accept credit and debit card payments by using card payment processors. Accepting cards offers convenience to customers and reduces the risk of handling large amounts of cash. However, businesses incur fees for processing card transactions.

Digital Payment Solutions

With the advent of technology, digital payment solutions have become increasingly popular. These solutions offer convenience, speed, and security for both businesses and customers.

Mobile Wallets

Mobile wallets are applications installed on smartphones that allow users to store their payment information digitally. Users can make payments by simply scanning a QR code or tapping their phone on a point of sale (POS) terminal. Mobile wallets, such as Apple Pay and Google Pay, offer a secure way of making payments without the need to carry physical cards or cash.

QR Codes

QR codes are square-shaped barcodes that can be scanned by smartphones. Businesses can generate QR codes that represent a specific payment amount or a link to an online payment page. Customers can scan these QR codes using their mobile wallets, which automatically deducts the payment from their accounts. QR codes offer a quick and contactless way of making payments.

Online Payments

Online payments refer to the process of making payments through a website or online platform. Businesses can integrate payment gateways on their websites, allowing customers to enter their payment details and complete transactions. Online payments offer convenience and accessibility, as customers can make purchases from anywhere with an internet connection. However, businesses must ensure the security of their online payment systems to protect customer information.

Point of Sale (POS) Systems

Point of Sale (POS) systems are hardware and software solutions used by businesses to accept payments and manage their sales transactions. These systems offer various features and functionalities that streamline the payment process and enhance the overall customer experience.

Overview

POS systems typically consist of a combination of hardware components, such as cash registers, card readers, and barcode scanners, along with software applications that run on computers or mobile devices. These systems allow businesses to process payments, track inventory, generate sales reports, and manage customer data.

Benefits

POS systems offer several benefits to businesses, including improved efficiency, enhanced inventory management, and detailed sales reporting. By automating payment processes and integrating with other business systems, POS systems can save time and reduce human errors. Additionally, POS systems provide businesses with valuable insights into their sales performance, allowing them to make informed business decisions.

Types of POS Systems

There are different types of POS systems available, ranging from traditional cash registers to advanced cloud-based systems. Traditional cash registers are standalone devices that can process basic payments but lack advanced features. On the other hand, cloud-based POS systems offer more functionality and can be accessed from multiple devices. These systems store data in the cloud, allowing businesses to access their sales data from anywhere.

Contactless Payment Methods

Contactless payment methods have gained popularity due to their convenience and speed. These methods eliminate the need for physical contact between the customer’s payment instrument and the payment terminal, making transactions faster and more hygienic.

NFC Payments

Near Field Communication (NFC) payments use radio frequency technology to enable contactless transactions. NFC-enabled devices, such as smartphones or smartwatches, can be tapped or held near an NFC-enabled payment terminal to complete a transaction. NFC payments are secure and widely accepted, making them a popular choice for contactless payments.

Biometric Payments

Biometric payments use unique biological traits, such as fingerprints or facial recognition, to verify the identity of the payer. By linking the biometric information to a payment account, customers can make payments by simply authenticating themselves. Biometric payments provide an additional layer of security and convenience, as customers don’t need to carry physical cards or remember passwords.

Contactless Cards

Contactless cards, also known as tap-and-go cards, are credit or debit cards embedded with NFC technology. These cards can be tapped or waved near an NFC-enabled payment terminal to initiate a payment. Contactless cards offer a fast and convenient way to make payments, especially for small transactions. The adoption of contactless cards has significantly increased in recent years.

E-commerce Payment Gateways

E-commerce payment gateways are online services that facilitate the processing of online payments. These gateways securely capture and transmit payment information between the customer, the merchant, and the payment processor.

Definition

E-commerce payment gateways act as the intermediary between the customer’s payment instrument and the merchant’s website or online platform. When a customer makes a purchase online, the payment gateway securely captures the payment information, encrypts it, and transmits it to the payment processor for authorization. Once authorized, the payment gateway informs the merchant, allowing them to complete the transaction.

Popular E-commerce Payment Gateways

There are many e-commerce payment gateways available, each offering different features and pricing structures. Some popular payment gateways include PayPal, Stripe, and Square. These gateways support a wide range of payment methods, including credit/debit cards, digital wallets, and bank transfers. Merchants can choose the payment gateway that best fits their business needs and integrates seamlessly with their e-commerce platform.

Peer-to-Peer (P2P) Payment Apps

Peer-to-Peer (P2P) payment apps enable individuals to send and receive money directly from their mobile devices. These apps have become popular for splitting bills, paying friends or family, and making quick payments.

Introduction

P2P payment apps, such as Venmo, Zelle, and Cash App, allow users to link their bank accounts or debit/credit cards to their mobile devices. Users can then send money to others by simply entering the recipient’s mobile number or email address. P2P payment apps are known for their simplicity and convenience, making them a preferred choice for informal and small-scale transactions.

Benefits

P2P payment apps offer several benefits, including instant transfers, easy splitting of bills, and seamless integration with mobile devices. Users can quickly send and receive money, eliminating the need for cash or checks. These apps also provide a social aspect, allowing users to add comments or emojis to their transactions, enhancing the user experience.

Popular P2P Payment Apps

There are several popular P2P payment apps available in the market. Venmo, owned by PayPal, is widely used for peer-to-peer transactions and social payments. Zelle is a network of over 1,000 banks and credit unions that enables instant money transfers between participating institutions. Cash App, developed by Square, offers a range of features, including person-to-person payments and Bitcoin transactions.

Subscription Billing

Subscription billing refers to the recurring billing model used by businesses to charge customers for ongoing services or access to products. This model is commonly used by companies offering software-as-a-service (SaaS), streaming services, and membership-based businesses.

Overview

Subscription billing allows businesses to charge customers periodically, typically on a monthly or annual basis, for continued access to products or services. This model ensures a predictable revenue stream for businesses and provides convenience to customers by automating payment processes. Subscription billing is commonly used by businesses that offer digital products or services, such as cloud storage, streaming platforms, and subscription boxes.

Benefits

Subscription billing offers various benefits for businesses, including steady cash flow, increased customer loyalty, and simplified billing processes. By charging customers on a recurring basis, businesses can predict their revenue and plan their operations accordingly. Additionally, subscription billing encourages customer retention, as customers are more likely to continue using a product or service for which they are already paying.

Popular Subscription Billing Platforms

There are several subscription billing platforms available that cater to businesses of different sizes and industries. Some popular platforms include Stripe Billing, Recurly, and Chargify. These platforms provide businesses with the tools and infrastructure to manage their subscription billing processes, including recurring payments, billing cycles, and customer management.

Cryptocurrency Payments

Cryptocurrency payments involve the use of digital currencies, such as Bitcoin, Ethereum, or Litecoin, to make transactions. Cryptocurrencies provide an alternative form of payment that operates on decentralized blockchain technology.

Understanding Cryptocurrency

Cryptocurrencies are digital assets that use cryptography to secure transactions and control the creation of new units. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks, enabling peer-to-peer transactions without the need for intermediaries. Cryptocurrencies offer benefits such as enhanced security, transparency, and faster international transactions.

Accepting Cryptocurrency Payments

Businesses can accept cryptocurrency payments by integrating with payment processors or using cryptocurrency wallets. Payment processors convert the cryptocurrency received into the local currency, allowing businesses to avoid volatility risks. Cryptocurrency wallets, on the other hand, enable businesses to hold and manage their cryptocurrency funds directly. Accepting cryptocurrency payments can expand the customer base and provide businesses with exposure to the growing crypto economy.

Benefits of Cryptocurrency Payments

Cryptocurrency payments offer several advantages for businesses, including lower transaction fees, faster settlement times, and global accessibility. Cryptocurrencies eliminate the need for intermediaries, reducing transaction costs and enabling businesses to offer lower prices to customers. Additionally, cryptocurrency transactions can be settled within minutes, compared to traditional payment methods that may take days. Lastly, accepting cryptocurrency payments opens up new market opportunities and attracts tech-savvy customers.

Virtual Terminals

Virtual terminals are web-based applications that allow businesses to process card-not-present transactions, such as over-the-phone or mail orders. These terminals enable businesses to securely enter customer payment information and complete transactions manually.

Definition

Virtual terminals provide businesses with a secure web interface for manually processing payments using customer card details. Businesses can enter the customer’s card information, including the card number, expiration date, and CVV code, into the virtual terminal. The transaction is then securely processed by the payment gateway, allowing businesses to accept card payments without a physical card reader.

Advantages

Virtual terminals offer several advantages for businesses, including flexibility, increased sales channels, and improved security. By providing the ability to accept card-not-present transactions, businesses can expand their sales channels beyond physical stores. Virtual terminals also enhance security, as customer payment information is securely transmitted through encrypted connections, reducing the risk of data breaches.

Use Cases

Virtual terminals are commonly used by businesses that receive orders via phone, email, or mail, and by those involved in the hospitality and service industries that require convenient payment methods for customers. Virtual terminals allow businesses to securely accept payments in different scenarios, such as booking reservations, ordering products remotely, or processing donations.

Integrated Payment Systems

Integrated payment systems combine the functionality of payment processing with other business operations, such as inventory management, customer relationship management (CRM), and accounting. These systems streamline business operations and enhance the overall efficiency of payment processes.

What are Integrated Payment Systems?

Integrated payment systems integrate payment processing into existing business software or platforms, eliminating the need for separate payment terminals or devices. These systems allow businesses to accept payments directly within their existing software, such as POS systems or e-commerce platforms, providing a seamless experience for both businesses and customers.

Benefits of Integrated Payment Systems

Integrated payment systems offer several benefits, including streamlined workflows, reduced manual errors, and improved customer experience. By integrating payment processing into existing systems, businesses can automate the payment process, saving time and reducing the risk of errors. Additionally, integrated systems provide a unified view of customer information and transaction histories, enabling businesses to provide personalized and efficient customer service.

Examples of Integrated Payment Systems

There are various integrated payment systems available in the market, each catering to specific business needs and industries. Some popular examples include Square for Retail, Shopify POS, and Lightspeed. These systems seamlessly integrate with existing business platforms, offering a comprehensive solution for payment processing, inventory management, and customer relationship management.

In conclusion, there are numerous payment options available for businesses to choose from, each with its own benefits and considerations. Traditional payment options like cash, checks, and credit/debit cards remain widely used, while digital payment solutions like mobile wallets, QR codes, and online payments provide added convenience and security. Point of sale (POS) systems offer businesses a comprehensive solution for payment processing and sales management. Contactless payment methods like NFC payments, biometric payments, and contactless cards provide a fast and hygienic way of making payments. E-commerce payment gateways enable secure online transactions, while P2P payment apps facilitate quick mobile payments between individuals. Subscription billing platforms automate recurring payments, while cryptocurrency payments introduce a new form of digital currency. Virtual terminals allow businesses to accept card-not-present transactions, and integrated payment systems combine payment processing with other business operations, streamlining workflows. With the variety of payment options available, businesses can choose the methods that best suit their needs and provide a seamless payment experience for their customers.

Leave a Reply