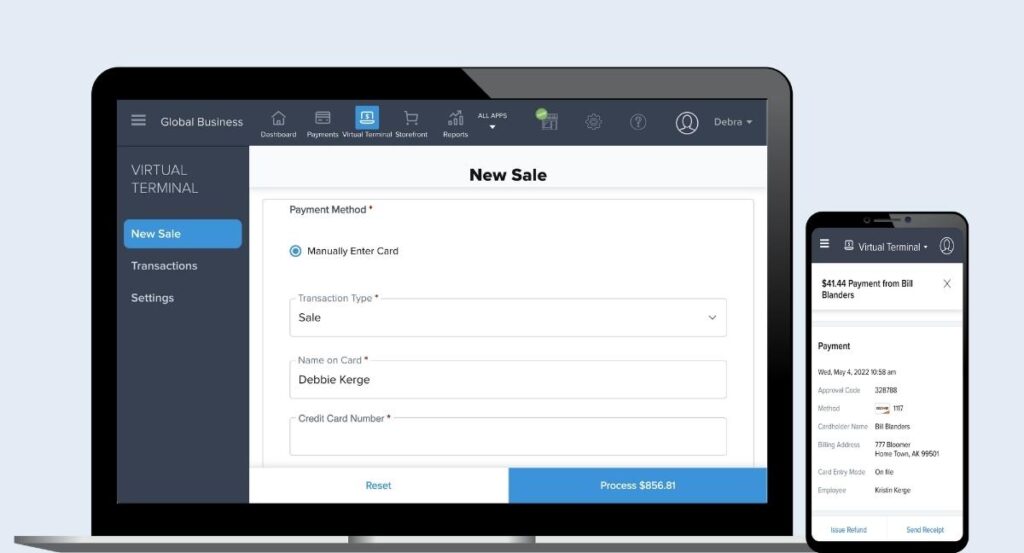

In an ever-evolving digital landscape, the world of payment processing is poised for significant transformation. As we move beyond the year 2023, virtual terminals are emerging as a compelling alternative to traditional payment methods. These cutting-edge platforms enable businesses to seamlessly accept payments through an online interface, presenting a myriad of benefits for both merchants and customers alike. This article will explore the future of payment processing, specifically focusing on the potential implications and advantages of virtual terminals in the years to come.

Benefits of Virtual Terminals

Increased Security

Virtual terminals offer enhanced security measures compared to traditional payment methods. With virtual terminals, sensitive payment information is securely transmitted and stored, reducing the risk of data breaches. Encrypted transactions ensure that customer data remains safe from potential hackers. Additionally, virtual terminals often utilize tokenization, which replaces sensitive cardholder information with unique tokens. This further protects customer data by minimizing the amount of sensitive information stored within merchant systems. By prioritizing security, virtual terminals instill customer confidence and trust in businesses.

Convenience for Customers

Virtual terminals provide a seamless and convenient payment experience for customers. With virtual terminals, customers can make payments from the comfort of their own homes, eliminating the need to physically visit a store or provide payment details over the phone. This convenience extends to various platforms, including desktop computers, laptops, tablets, and smartphones. By offering multiple channels for payments, virtual terminals cater to the diverse preferences of customers, ultimately improving customer satisfaction and loyalty.

Easy Integration with Existing Systems

One of the key benefits of virtual terminals is their compatibility with existing systems. Businesses can easily integrate virtual terminals into their current infrastructure without the need for major overhauls or disruptions. Virtual terminals can be seamlessly integrated with existing point-of-sale (POS) systems, e-commerce platforms, and accounting software, enabling businesses to efficiently manage their finances and streamline their operations. This integration allows businesses to maintain continuity while benefiting from the advantages offered by virtual terminals.

Evolution of Virtual Terminals

Early Forms of Virtual Terminals

Virtual terminals have come a long way since their inception. The early forms of virtual terminals required businesses to manually enter payment information into a computer terminal to process transactions. These terminals were usually connected to landlines, and transactions were often slow and cumbersome. Despite these limitations, virtual terminals revolutionized payment processing by eliminating the need for physical credit cards and enabling remote payments.

Advancements in Technology

Advancements in technology have significantly improved virtual terminals. With the advent of the internet, virtual terminals have become faster, more efficient, and user-friendly. The introduction of secure online gateways and payment processors has streamlined the transaction process, making it easier for businesses to accept payments online. Additionally, cloud-based virtual terminals have emerged, allowing businesses to access their payment systems from anywhere in the world, further enhancing flexibility and convenience.

Mobile and Contactless Payments

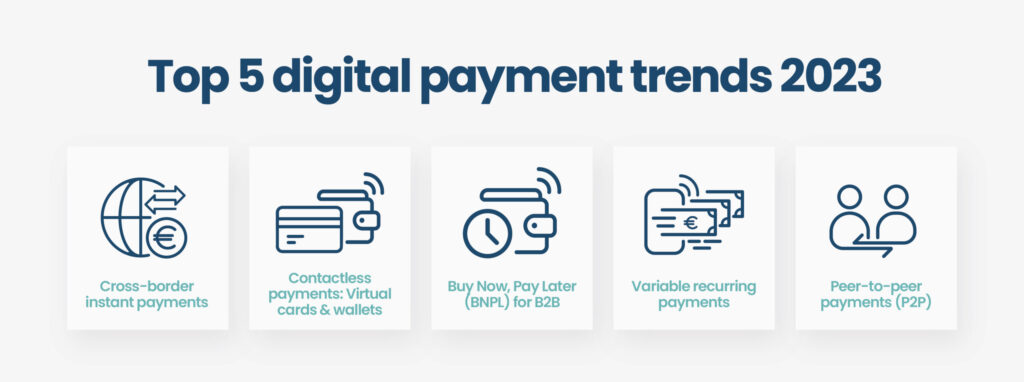

The rise of mobile technology has fueled the evolution of virtual terminals. Mobile virtual terminals, enabled by smartphones and tablets, have become increasingly popular for businesses on the go. With the integration of near-field communication (NFC) technology, customers can make contactless payments by simply tapping their smartphones or cards on compatible payment terminals. This convenient and secure method of payment is gaining traction in various industries, such as retail, hospitality, and transportation.

Emerging Trends in Virtual Terminals

Blockchain and Cryptocurrency Integration

As the popularity of cryptocurrencies, such as Bitcoin, continues to grow, virtual terminals are exploring ways to integrate blockchain technology. Blockchain offers secure and transparent transactional records, facilitating faster and more efficient cross-border transactions. By incorporating cryptocurrencies into virtual terminals, businesses can cater to a broader range of customers and offer alternative payment methods that align with the digital economy.

Artificial Intelligence and Machine Learning

Virtual terminals are harnessing the power of artificial intelligence (AI) and machine learning (ML) to enhance transaction processing and fraud detection. AI and ML algorithms can analyze large volumes of data in real-time, identifying patterns and anomalies that indicate fraudulent activity. By leveraging these technologies, virtual terminals can effectively mitigate the risks associated with fraudulent transactions, improving security and trust for both businesses and customers.

Biometric Authentication

Biometric authentication methods, such as fingerprint and facial recognition, are being integrated into virtual terminals to provide enhanced security and convenience. Biometric authentication eliminates the need for passwords and PINs, reducing the risk of identity theft and unauthorized access. By leveraging biometric data, virtual terminals can offer a frictionless payment experience, allowing customers to complete transactions effortlessly while ensuring the highest level of security.

Impacts of Virtual Terminals on Businesses

Efficiency and Time Savings

Virtual terminals streamline payment processing, enabling businesses to operate more efficiently and save valuable time. With virtual terminals, businesses can automate the payment acceptance process, reducing manual tasks and human errors. Additionally, virtual terminals can offer features such as recurring billing and invoicing, further simplifying financial management for businesses. By streamlining payment procedures, virtual terminals free up time for businesses to focus on core operations, ultimately increasing productivity and profitability.

Expanded Customer Base

Virtual terminals open up new possibilities for businesses to reach and serve a global customer base. By accepting online payments through virtual terminals, businesses can cater to customers from different geographical locations, breaking down barriers and expanding market reach. Virtual terminals also allow businesses to accept various payment methods, including credit cards, debit cards, and digital wallets, accommodating the diverse preferences of customers. These expanded capabilities enable businesses to tap into new revenue streams and gain a competitive edge in the digital landscape.

Reduced Costs

Virtual terminals offer cost-saving advantages for businesses. By migrating from traditional payment methods to virtual terminals, businesses can eliminate the costs associated with physical equipment, such as card readers and terminals. Virtual terminals also reduce the need for paper-based transactions, decreasing expenses related to printing, postage, and storage. Furthermore, the automation and streamlined processes offered by virtual terminals minimize the need for manual labor and administrative tasks, reducing labor costs for businesses.

Challenges and Concerns

Data Security and Privacy

As virtual terminals continue to evolve, ensuring robust data security and privacy measures remains a top concern. The collection and storage of sensitive customer information pose potential risks if not adequately protected. Businesses must implement comprehensive security protocols, such as encryption, tokenization, and secure data storage, to safeguard customer data from cyber threats. Additionally, compliance with relevant data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial to maintaining customer trust and avoiding costly penalties.

Integration Challenges

Despite the numerous benefits of virtual terminals, integrating them into existing systems can present challenges for businesses. Compatibility issues between different platforms and software may arise, requiring additional time and resources for implementation. Businesses need to ensure that their existing infrastructure is capable of supporting virtual terminals and make any necessary updates or improvements. Seamless integration is essential for businesses to fully leverage the advantages of virtual terminals without disrupting their operations.

Risk of Fraud

While virtual terminals offer enhanced security features, the risk of fraud still exists. Cybercriminals are constantly evolving, finding new ways to exploit vulnerabilities in payment systems. Businesses must stay vigilant and implement robust fraud detection and prevention measures. This includes regularly monitoring transactions, analyzing patterns, and employing AI and ML technologies to identify and mitigate potential fraudulent activities. By prioritizing fraud prevention, businesses can effectively protect their customers’ data and maintain a secure payment environment.

Regulatory Environment and Compliance

Payment Card Industry Data Security Standard (PCI-DSS)

Virtual terminals must adhere to the Payment Card Industry Data Security Standard (PCI-DSS), which sets guidelines for storing, processing, and transmitting cardholder data. Compliance with PCI-DSS ensures that businesses maintain the highest level of security when handling payment information. By meeting these stringent requirements, businesses can build trust with customers and avoid potential legal and financial ramifications associated with non-compliance.

General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR) is a crucial regulation that businesses utilizing virtual terminals must comply with. GDPR governs the collection, storage, and processing of personal data of EU citizens. Businesses must obtain explicit consent from customers, implement appropriate security measures, and provide individuals with control over their personal data. Non-compliance with GDPR can result in severe penalties, highlighting the importance of adhering to these regulations when handling customer data.

Consumer Protection Laws

Virtual terminals must also comply with various consumer protection laws to ensure fair and transparent practices. These laws vary by jurisdiction and typically cover areas such as refund policies, dispute resolution mechanisms, and disclosure requirements. By following these regulations, businesses can cultivate trust with their customers and demonstrate their commitment to consumer rights and protections.

The Role of Virtual Terminals in E-Commerce

Enhancing User Experience

Virtual terminals play a pivotal role in enhancing the user experience in e-commerce. By providing a seamless and secure payment process, virtual terminals minimize checkout friction, reducing cart abandonment rates. The ability to accept various payment methods and currencies also caters to the diverse needs and preferences of customers worldwide. Virtual terminals ensure a smooth and positive user experience, leading to higher customer satisfaction, repeat business, and positive reviews.

Providing Alternative Payment Methods

Virtual terminals enable businesses to offer alternative payment methods that cater to specific customer segments. This includes digital wallets like PayPal and Apple Pay, as well as Buy Now, Pay Later (BNPL) services. By integrating these options into virtual terminals, businesses can attract and retain customers who prefer non-traditional payment methods. Offering a diverse range of payment options enhances the overall shopping experience, fostering customer loyalty and driving sales.

Streamlining Checkout Processes

Virtual terminals streamline checkout processes, reducing the steps required for customers to make a purchase. By offering features such as pre-filled payment information, automatic address verification, and one-click purchasing, virtual terminals simplify and expedite the checkout process. This not only improves conversion rates but also instills confidence in customers by ensuring a seamless and hassle-free shopping experience.

Integration with Mobile Devices

Mobile Payment Apps

Integration with mobile payment apps has become an integral aspect of virtual terminals. Mobile payment apps, such as Google Pay and Samsung Pay, enable customers to make quick and secure payments using their smartphones. By integrating these apps into virtual terminals, businesses can cater to the growing number of customers who prefer mobile payments. Mobile payment apps offer convenience, accessibility, and enhanced security, making them a valuable addition to virtual terminals.

Near Field Communication (NFC)

Near Field Communication (NFC) technology allows smooth and contactless payments between devices in close proximity. Virtual terminals can leverage NFC capabilities to enable customers to make payments by simply tapping their smartphones or cards on compatible payment terminals. NFC technology ensures secure and efficient transactions, reducing the need for physical interactions during the payment process. By incorporating NFC into virtual terminals, businesses can offer cutting-edge payment options, improving customer satisfaction and convenience.

QR Code Payments

QR code payments have gained popularity due to their simplicity and versatility. Virtual terminals can generate unique QR codes that customers can scan using their smartphones to complete payments. This method eliminates the need for physical cards or devices and enables businesses to accept payments from various mobile payment apps. QR code payments offer a fast and secure payment option, making them an attractive feature for virtual terminals.

Virtual Terminals in Different Industries

Retail and Point-of-Sale Systems

Virtual terminals have transformed the retail industry by providing efficient and secure payment solutions. Retail businesses can use virtual terminals to accept payments via multiple channels, including e-commerce websites, mobile apps, and in-store POS systems. Virtual terminals enable retailers to offer contactless payments, digital receipts, and loyalty program integration. By embracing virtual terminals, retailers can enhance the overall customer experience, streamline operations, and increase sales.

Hospitality and Food Services

The hospitality and food service industries have greatly benefited from the integration of virtual terminals. Virtual terminals allow fast and convenient payments at hotels, restaurants, and cafés. With features like tableside ordering and mobile payments, virtual terminals streamline the ordering and payment process, reducing wait times and enhancing customer satisfaction. Secure transactions and the ability to split bills and process tips efficiently make virtual terminals indispensable for businesses in these industries.

Healthcare and Medical Billing

Virtual terminals have revolutionized medical billing and payment processes in the healthcare industry. Healthcare providers can securely process payments, verify insurance information, and handle invoicing through virtual terminals. These terminals also facilitate telehealth services, allowing patients to make remote payments for consultations and services. Virtual terminals equipped with proper security measures ensure compliance with healthcare regulations, simplifying payment collection and improving administrative efficiency.

Predictions for the Future of Virtual Terminals

Further Advances in Biometric Technology

The future of virtual terminals will likely witness further advances in biometric technology. Biometric authentication methods, such as voice recognition and iris scanning, may become more prevalent, offering even greater security and convenience. These advancements will eliminate the need for physical payment devices and enhance the overall user experience, making transactions effortless and secure.

Decentralized Payment Systems

Blockchain technology and decentralized payment systems hold promise for the future of virtual terminals. Decentralized systems can enable peer-to-peer transactions without relying on traditional intermediaries, such as banks. This could potentially reduce transaction fees and increase security and privacy. By leveraging the transparency and security of blockchain technology, virtual terminals can provide a secure and efficient payment environment, revolutionizing the way transactions are conducted.

Seamless Integration with Internet of Things (IoT)

The Internet of Things (IoT) is expected to play a significant role in the future of virtual terminals. With the integration of IoT devices, such as smart home assistants and wearables, virtual terminals can offer personalized and context-aware payment experiences. For example, virtual terminals can automatically detect when a customer enters a store and initiate the payment process, eliminating the need for manual interaction. Seamless integration with IoT devices will enhance convenience and further streamline the payment process.

In conclusion, virtual terminals offer numerous benefits, including increased security, convenience for customers, and easy integration with existing systems. The evolution of virtual terminals has seen advancements in technology, mobile and contactless payments, and the integration of emerging trends such as blockchain and AI. These advancements have had a positive impact on businesses, improving efficiency, expanding customer bases, and reducing costs. However, challenges and concerns regarding data security, integration, and fraud remain crucial considerations. Regulatory compliance, especially with PCI-DSS and GDPR, is essential to ensure the protection of customer data and adherence to consumer protection laws. Virtual terminals play a vital role in e-commerce, enhancing user experience, providing alternative payment methods, and streamlining checkout processes. Integration with mobile devices, including mobile payment apps, NFC, and QR code payments, further adds to the convenience and accessibility of virtual terminals. Virtual terminals have found applications in various industries, such as retail, hospitality, and healthcare, revolutionizing their payment processes. Looking ahead, further advances in biometric technology, decentralized payment systems, and integration with IoT devices hold exciting possibilities for the future of virtual terminals and the payment processing landscape.

Leave a Reply